MARKET UPDATE – May 15, 2017

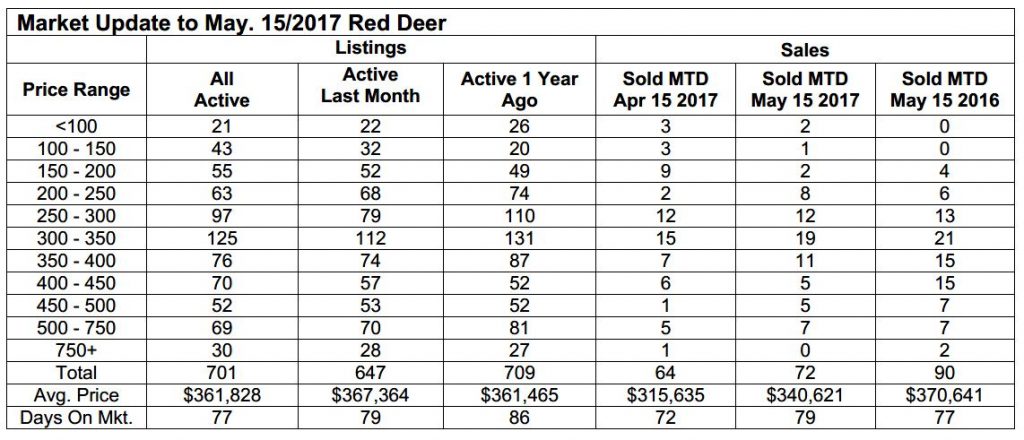

Red Deer sales in the first two weeks in May were up from the same time in April, but down compared to the first two weeks of May 2016. Year to date sales in Red Deer continue to lag behind the same time last year while overall central Alberta sales are up 7.5% year over year.

There have been many reports that the Alberta economy is improving after two years of recession. Several leading economic indicators are referenced in support of that theory. Oil prices have spent most of 2017 hovering over US$50, just recently dropping under that magic mark. Ramped up production in the US and Canada has increased supplies again, driving prices down. Recent news that OPEC has stated they are willing to do whatever it takes to keep prices stable has pushed the price back closer to US$50 in the last few days.

No matter what the politicians tell us, the strength of the Alberta economy is still heavily reliant on energy. There is no doubt that higher prices have increased activity in our energy sector, and more economic activity in any sector helps boost all the other sectors. But to assume that will change the housing market overnight would be a bit of a stretch.

Many people employed by the energy industry are back at work, but at reduced incomes. Energy company profits are still thin, but those still in business have become much more efficient and able to survive in the new lower price reality. It will take some time for their employees to get back on their feet and start thinking about investing money in new homes.

In the meantime, the housing market has survived based on activity by those not as affected by energy prices. Those families have an amazing opportunity to take advantage of more choice, less competition, lower prices and very low interest rates. Those with 20% down payments are in the best position to take advantage.

Buyers with less than 20% down require their mortgages to be insured and the federal government made that much more difficult with rules that require buyers to qualify at a high artificial rate as opposed to the actual rate they can borrow at.

The purpose of that program was to slow down heated markets in Toronto and Vancouver. Unfortunately the policy was applied across Canada and has had a very negative effect on markets already affected by low energy prices.

In a nutshell, the central Alberta real estate market has survived and will continue to do so. Ample supply and low demand in virtually every price range have moved prices off their highs reached in 2014. Smart buyers will take advantage now if they can. It is difficult to go against the flow and easy to think that prices may still go lower, but once those economic indicators start to turn, it is likely real estate prices aren’t too far behind.