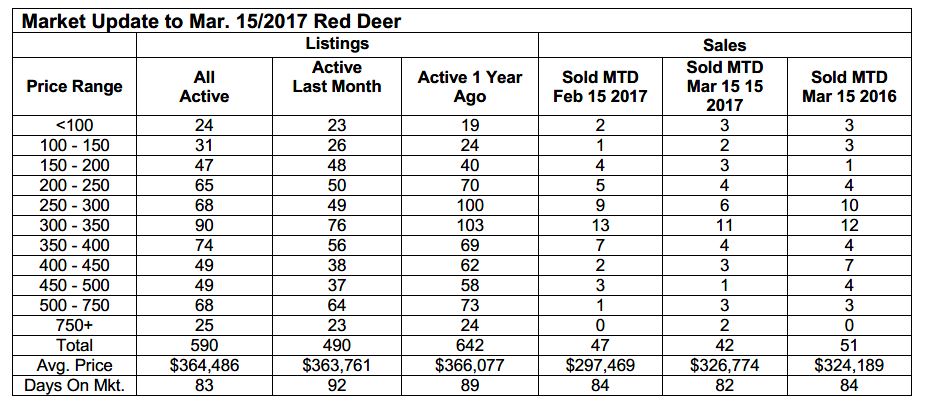

MARKET UPDATE – MARCH 15, 2017

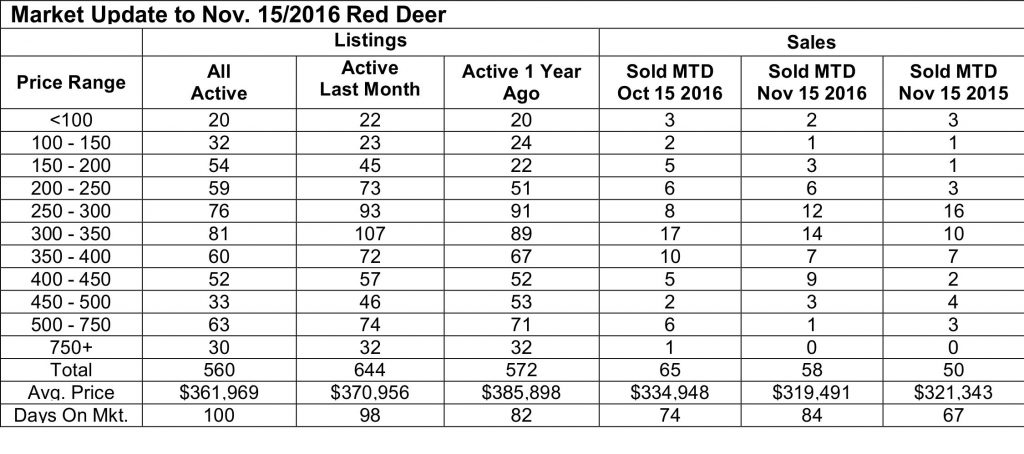

Tuesday, March 21st, 2017Mid month sales in March were down a little in Red Deer when compared to last month. We would like to blame that slower market on the weather, but that wouldn’t explain why sales are even or up in our other central Alberta markets compared to this time last month.

The number of active listings is up across all of central Alberta, which is normal for this time of year, although recent optimism about the economy may have encouraged a few more sellers to test the water. Year to date sales for all of central Alberta are up 8.8% when compared to the same time last year, a sign that the market is finally turning.

Moving into the third year of an exceptionally tough economic slowdown, the market has survived remarkably well. However, buyers still have the advantage, and probably will for much of the year. Anyone that is able to buy now should give serious consideration to the fact that interest rates are predicted to rise and if the market recovers, prices will as well.

No one can identify the bottom of the market exactly, but there is some evidence we are very close. Anyone looking to take advantage should do so soon.

February Job Numbers Show Signs of Improvement, ATB Financial

Even though the job situation for thousands of Albertans is still difficult, Statistics Canada’s latest employment report shows a slight improvement in February.

Between January and February, Alberta’s labour market gained approximately 1,300 jobs. Despite shedding 18,000 part-time jobs last month, the good news for Alberta’s economy is that this decrease was offset by 19,300 full-time jobs, suggesting a generous increase in the quality of available work.

The size of Alberta’s labour force (i.e., the number of people actively working or looking for work) fell by 14,100 people in February. The decline in the labour force may indicate that those in search of work are starting to feel discouraged. That said, the drop in the size of Alberta’s labour force and the net gain to employment was enough to nudge the provincial unemployment rate down from 8.8 per cent in January to 8.3 per cent in February.

February’s job report has shown early promise and potentially set a theme of modest growth for this year. Still, employers may remain reluctant to start hiring back too many workers which suggests Alberta job seekers could experience a few more difficult months. However, with stability in various sectors and overall business confidence improving, the job market will continue to show positive progress, in moderation.