MARKET UPDATE: October 15, 2016

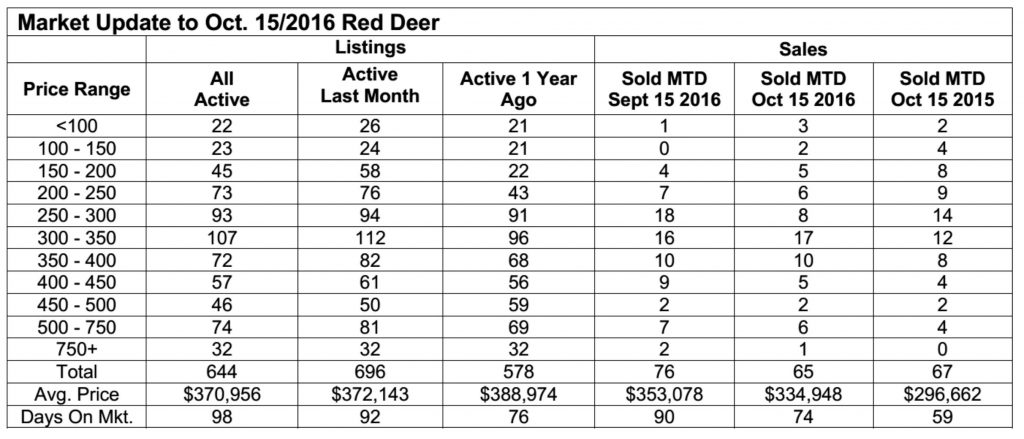

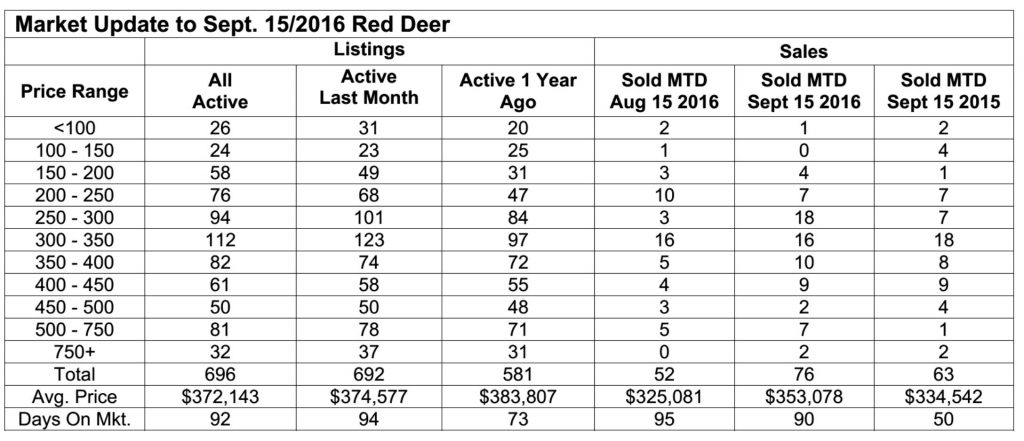

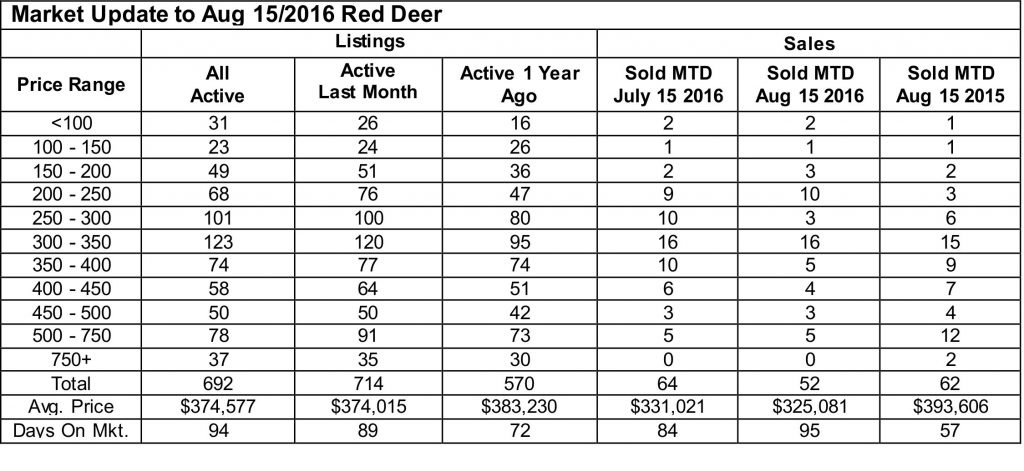

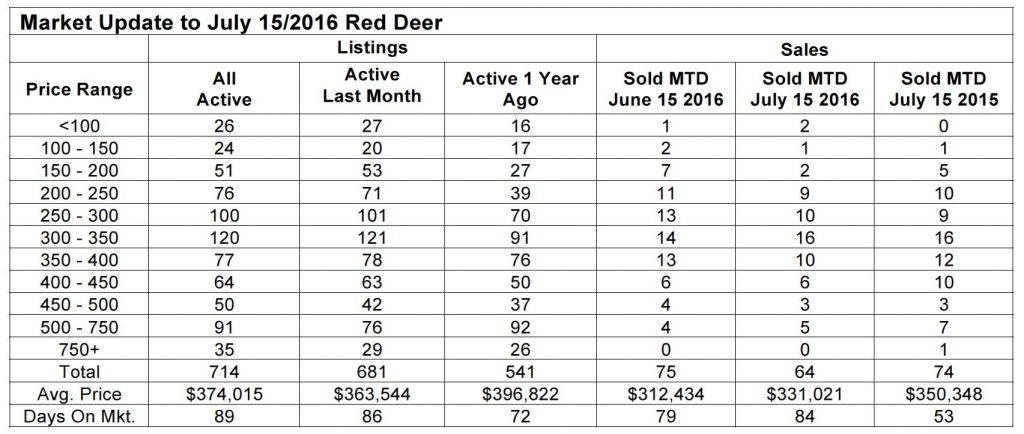

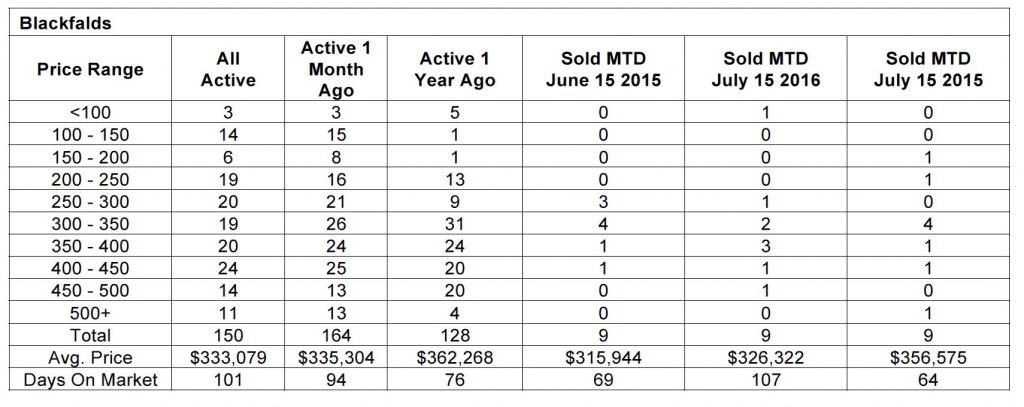

Tuesday, November 8th, 2016The number of active listings is down again, a very good sign that the economy and housing market are heading in the right direction. Sales were off a little in the first two weeks of October compared to the same time in September, but still very acceptable, all things considered.

The most active market continues to be between $300,000 and $400,000, which also has the highest number of active listings. A good balance between supply and demand in that price range means buyers will continue to have lots of choices while serious sellers will continue to have buyers for their homes.

Housing Starts Rebound – Todd Hirsch, Chief Economist, ATB Financial

Shiny new condominium projects and charming new subdivisions have become familiar sights in Alberta, but there’s no question that the pace of new home construction has been slowed by the recession. However, new data from the Canada Mortgage and Housing Corporation are more positive.

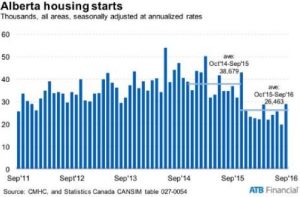

After hitting a multi-year low in August, housing starts in Alberta roared back in September. Builders began construction on nearly 29,000 units last month, up from less than 20,000 the month prior. (The figures are seasonally adjusted to take into account regular and predictable fluctuations that occur each month; they are also presented at annualized rates, meaning the number of homes that would be built in an entire year if the same pace of activity was maintained for 12 months).

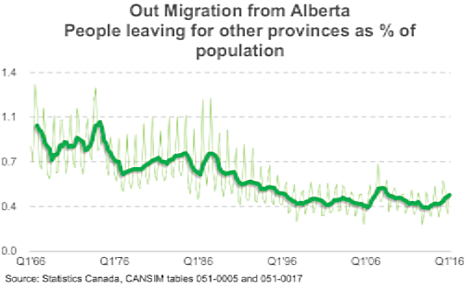

There are few economic statistics that are better indicators of consumer sentiment than housing starts. The drop in new home building activity over the last two years—illustrated clearly in the graph below—suggests Albertans have become a bit more hesitant to make a major purchase like a new home. It also reflects weaker demand as fewer people have been moving to Alberta. Over the last 12 months, total starts are down 32 per cent compared to the previous 12 months.

The good news is that home builders are pulling back on supply in reaction to softer demand—and that has helped keep the residential real estate market in reasonably good balance. New home prices have been virtually unchanged in Alberta’s two major cities throughout the downturn.