September 5 2015 – Market Update

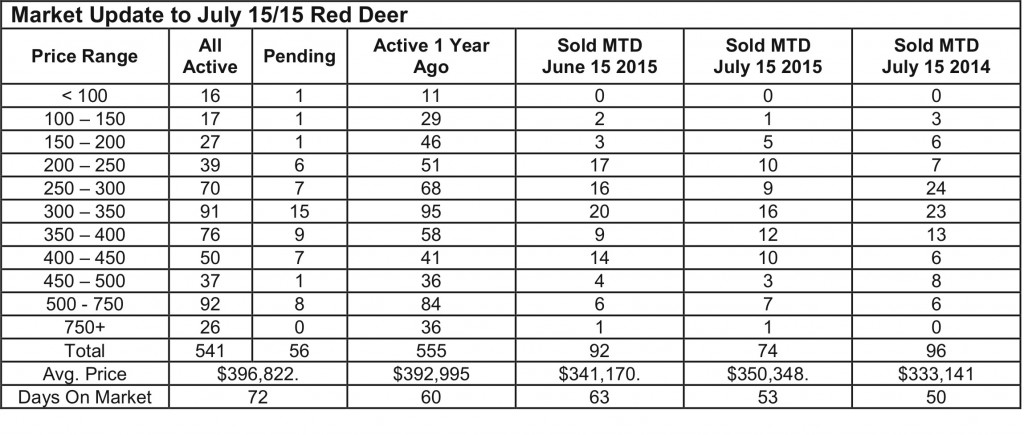

Friday, September 11th, 2015Sales in August slipped while the number of active listings increased slightly. It is likely that we are now seeing the first signs

of low oil prices in the housing market. Historically, slower sales and higher inventory levels in Alberta have occurred about

a year after a slowdown in the energy industry.

The Red Deer market has finally moved into balance after giving sellers the advantage for several months. Extremely low

interest rates have been influential in our strong market so far this year. Higher supply and lower demand will have a

calming effect on prices this fall and combined with those low interest rates, will create an ideal environment for buyers who

are not affected by the energy industry slowdown.

Opinions on where energy prices are going vary. Some believe that OPEC will reduce production while US oil reserves are

shrinking more quickly than previously forecasted. Others believe the price of oil will remain below $50 for at least another

year. Whatever the case, the world still needs vast amounts of oil every day and energy companies will adapt to their

environment. The Alberta economy does rely on a strong energy sector to fuel a “strong” economy, but we will survive this

downturn the same as previous ones and come out of it stronger, smarter and more efficient. That’s what Albertans do.