Red Deer Market Update – July 15

Friday, July 16th, 2010

| Market Update to July 15/10 Red Deer | ||||||

|

Price Range |

All Active |

Pending |

Active 1 Year Ago |

Sold MTD July 8/10 |

Sold MTD July 15/10 |

Sold MTD July 15/09 |

|

< 100 |

19 |

0 |

26 |

1 |

2 |

0 |

|

100 – 150 |

46 |

2 |

30 |

0 |

1 |

1 |

|

150 – 200 |

84 |

1 |

64 |

3 |

5 |

12 |

|

200 – 250 |

106 |

7 |

103 |

3 |

9 |

18 |

|

250 – 300 |

144 |

7 |

89 |

7 |

13 |

19 |

|

300 – 325 |

82 |

4 |

45 |

1 |

6 |

14 |

|

325 – 350 |

78 |

6 |

44 |

1 |

5 |

7 |

|

350 – 375 |

53 |

3 |

32 |

1 |

2 |

4 |

|

375 – 400 |

52 |

0 |

34 |

2 |

4 |

6 |

|

400 – 450 |

61 |

1 |

46 |

2 |

5 |

3 |

|

450 – 500 |

33 |

1 |

23 |

2 |

4 |

2 |

|

500+ |

76 |

2 |

65 |

2 |

6 |

1 |

|

Total |

834 |

34 |

601 |

25 |

62 |

87 |

|

Avg. Price |

$327,347. |

$322,164. |

$365,856. |

$344,858. |

$284,413. |

|

|

Days On Market |

50 |

49 |

58 |

52 |

45 |

|

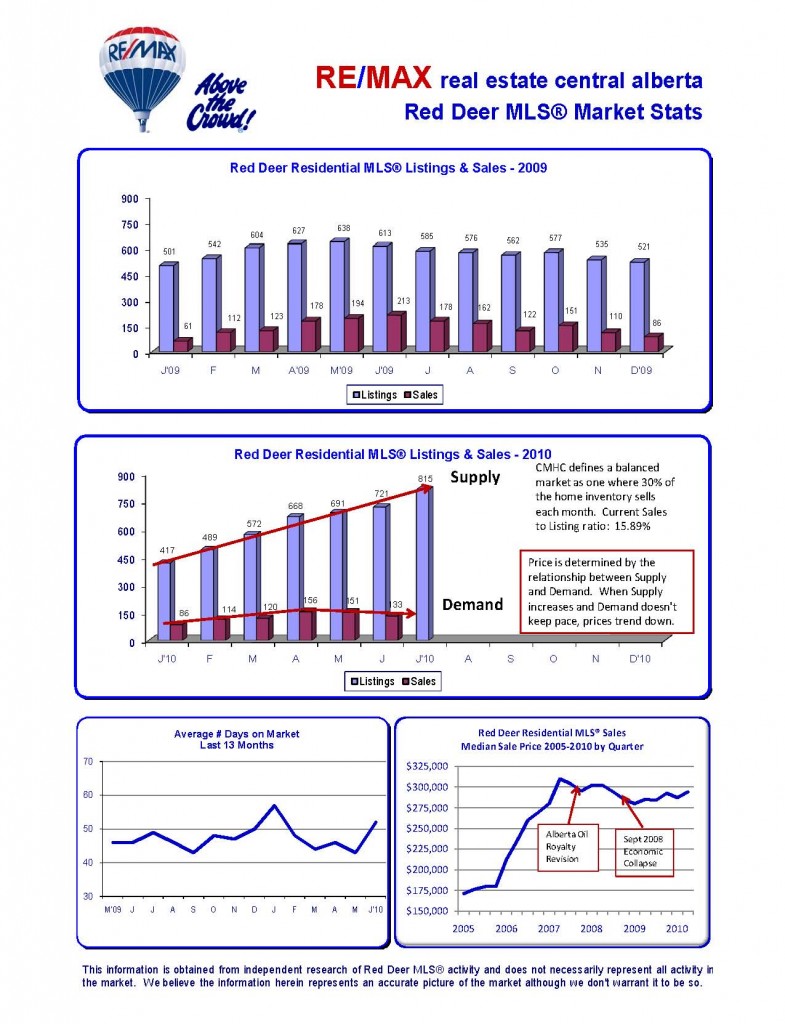

· ATB Financial – Weekly Bulletin – July 10 – Residential developers in Alberta started construction on 24,900 homes in June 2010, a drop of 1,800 compared to the month previous but well ahead of the pace one year ago when builders started only 17,800 homes. All figures have been seasonally adjusted and annualized, which means it is the number of homes that would be built during the year if construction continued as it did for the month. This was the second consecutive month of declining housing starts in Alberta, confirming that the mood has cooled in the residential construction sector after a fairly strong period in late 2009 and early 2010.

Drilling down by region, it appears that multi-family construction (includes condominiums, duplexes and town houses) in Edmonton bore the brunt of the provincial drop in housing starts. However, housing starts have been much stronger in Edmonton than Calgary over the last few months, so even though starts in Edmonton slipped from the month before they are still higher than in Calgary.

Moving forward, it is very likely that housing starts will continue to stay subdued compared to the beginning of the year. So far in 2010, housing starts have averaged 26,700 units, which is much stronger than during 2009 which saw fewer than 20,000 new home starts. However, it’s still well below the pace of 2006 and 2007 when over 40,000 new homes were started.

· Local Market Comment – The central Alberta market is a reflection of what is happening in the rest of the province. The reason new housing starts are slowing is because we haven’t had the population growth to sustain the pace we were on.

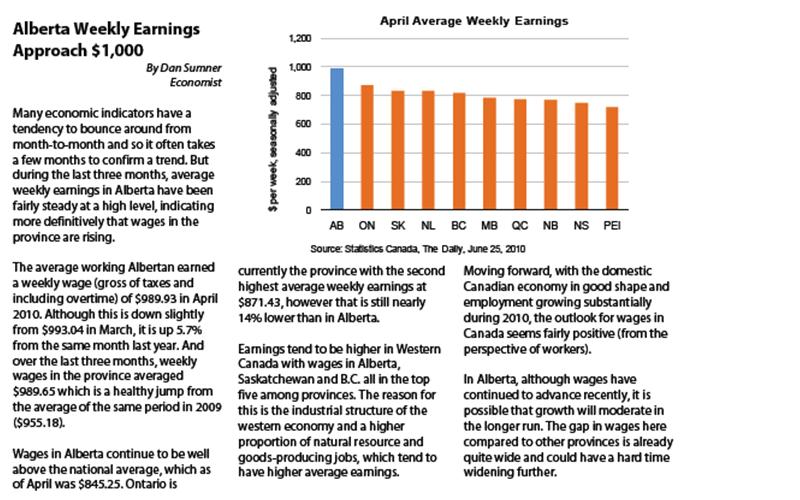

The reason we haven’t had population growth is because we had negative job growth in the last two quarters of 2009 and only a very small net gain in the first quarter of 2010. There were a lot of jobs created in Canada in the last quarter but almost all of them were in Ontario and Quebec. For the first time in years, Alberta has been lagging behind the rest of the country when it comes to job growth.

The reason we haven’t had job growth here is because there has been low demand for commodities in the world wide economic slowdown we have been experiencing for the past two years. It’s never quite that simple though. There are other factors that have had an effect on our local economy. As an example, the Alberta Provincial Royalty review and subsequent changes to the oil and natural gas royalty structure caused jobs and workers to move to Saskatchewan and B.C.

There are some positive signs that job creation in Alberta may be on the upswing. Well licences are up over last year, oil and gas land lease sales are up over last year, there are more drilling rigs working than at this time last year and well completions are up over last year. All very positive signs of recovery in the energy sector and when the energy sector recovers in Alberta, everything else follows behind.