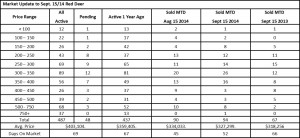

Strong sales continue in the first two weeks of September combined with adequate inventory in almost every price range except $450,000 to $500,000 where the pickings are a little slimmer.

We are often asked what the market is going to do in the future. While no one can predict the future, the following articles from ATB are strong indicators that the future looks very promising in central Alberta.

Alberta’s Population Projected to Climb – Todd Hirsch, Chief Economist, ATB Financial – The number of people living in Alberta will grow no matter what, according to the latest population projections by Statistics Canada. The present population of Alberta is 4.1 million. Under six various growth scenarios, the province’s population will range from a low of 5.6 million to a high of 6.8 million by the year 2038. The high growth scenario would essentially see the addition of another Calgary, Edmonton and Red Deer combined over the next 24 years.

“In all scenarios, population growth in Alberta would be the highest among Canadian provinces over the next 25 years,” said the statistical agency in a press release this morning. It also notes that these projections are not forecasts. Forecasts suggest what will most likely occur in the future; projections represent an attempt to establish plausible long-term scenarios.

Under the same growth scenarios, Canada’s total population will grow from its current 35.2 million to anywhere between 39.4 million and 47.8 million in the same time frame. A longer-term population projection for the country could see it reach 63.5 million by the year 2063. Economic trends are not considered in the exercise of population projections. Rather, Statistics Canada bases its assumptions on trends in fertility, life expectancy and migration. The latter of these—migration—is deeply tied to the economic performance of the province. As we’ve seen in recent quarters, Alberta’s strong job market continues to draw thousands of interprovincial and international migrants.

Oil and Gas producers Busier in Second Quarter – Todd Hirsch, Chief Economist, ATB Financial – More oil and gas rigs, drilling equipment and heavy transportation vehicles were being used in the spring of 2014 compared to earlier quarters. According to this morning’s Statistics Canada figures, the industrial capacity utilization rate in Canada’s oil and gas extraction industries rose to 88.0 per cent. That’s the highest rate in 11 years.

The industrial capacity utilization rate is a measure of existing slack in the economy. It is the ratio of an industry’s actual output to its estimated potential output, given the fixed amount of buildings, factories, machinery and equipment currently available. The closer the ratio is to 100 per cent, the less slack there is in the system.

Nationally, industrial capacity also tightened to a utilization rate of 82.7 per cent, the highest since the second quarter of 2007. Statistics Canada reports that manufacturing industries were the main source of the increase. Much of Canada’s oil and gas extraction sector is based in Alberta, so capacity utilization in this sector is a good reflection of the pace of economic activity in this province.

Yet there is a distinct downside to the heightened activity: cost pressures for producers. As utilization rises, prices for available machinery, equipment and labour also rise. That puts upward pressure on the break-even point for many projects, particularly in the capital-intensive oilsands.