Red Deer Market Update – Dec. 17/10

Friday, December 17th, 2010| Market Update to Dec. 16/10 Red Deer | ||||||

| Price Range | All

Active |

Pending | Active 1 Year Ago | Sold MTD

Dec. 9/10 |

Sold MTD

Dec. 16/10 |

Sold MTD

Dec. 16/09 |

| < 100 | 20 | 0 | 19 | 4 | 4 | 3 |

| 100 – 150 | 34 | 1 | 27 | 1 | 1 | 2 |

| 150 – 200 | 58 | 1 | 40 | 5 | 6 | 4 |

| 200 – 250 | 63 | 1 | 65 | 7 | 8 | 8 |

| 250 – 300 | 109 | 11 | 99 | 9 | 10 | 5 |

| 300 – 325 | 46 | 3 | 39 | 5 | 6 | 9 |

| 325 – 350 | 39 | 2 | 45 | 0 | 0 | 4 |

| 350 – 375 | 25 | 0 | 22 | 3 | 3 | 6 |

| 375 – 400 | 36 | 0 | 29 | 1 | 1 | 6 |

| 400 – 450 | 36 | 2 | 32 | 0 | 0 | 3 |

| 450 – 500 | 27 | 2 | 20 | 1 | 1 | 1 |

| 500+ | 52 | 1 | 47 | 1 | 1 | 2 |

| Total | 545 | 24 | 484 | 37 | 41 | 53 |

| Avg. Price | $323,755. | $324,524. | $273,516. | $271,551. | $299,373. | |

| Days On Market | 69 | 57 | 58 | 60 | 51 | |

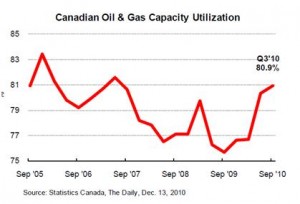

Capacity Utilization Rising in Energy Sector – Todd Hirsch, Senior Economist, ATB Financial

December 13, 2010 – High oil prices have been a lifeline for Alberta’s provincial economy in 2010. Those higher prices are showing up in how the industry is putting its resources to work.

The percentage of industrial capacity being used in Canada’s oil and gas drilling sector rose to 80.9% in the third quarter of 2010, up from 80.3% in the second quarter. The increase brings national utilization to its highest point since the spring of 2007—long before the crash in energy prices sent Alberta’s energy dependent economy spiralling into recession.

Total capacity utilization for all sectors in the country rose to 78.1% in the third quarter, up from 76.9% in the second quarter. It was the fifth consecutive increase since the record low rate of 67.8% in the second quarter of 2009.

Capacity utilization is a useful indicator that estimates how much machinery, equipment, and other production resources are being activity put to use. The higher the utilization rate, the smaller is the excess capacity. As utilization rates approach 100%, inflationary pressures start to build.

Utilization rates are not calculated at the provincial level, but the oil and gas sector in Canada is dominated by activity in Alberta.

At 80.9% capacity utilization, the energy sector is clearly in better shape than it was a year or two ago. Higher oil prices have been the main driver, and utilization rates are building. However, weak natural gas prices are still leaving plenty of spare capacity on that side of the industry.