Red Deer Weekly Market Update – September 24/10

Friday, September 24th, 2010|

Market Update to Sept. 23/10 Red Deer |

||||||

|

Price Range |

All Active |

Pending |

Active 1 Year Ago |

Sold MTD Sept. 16/10 |

Sold MTD Sept. 23/10 |

Sold MTD Sept. 23/09 |

|

< 100 |

26 |

1 |

24 |

0 |

2 |

3 |

|

100 – 150 |

41 |

1 |

30 |

5 |

5 |

2 |

|

150 – 200 |

71 |

2 |

56 |

5 |

7 |

6 |

|

200 – 250 |

102 |

5 |

115 |

11 |

15 |

20 |

|

250 – 300 |

145 |

3 |

74 |

15 |

23 |

20 |

|

300 – 325 |

51 |

3 |

45 |

5 |

11 |

11 |

|

325 – 350 |

68 |

4 |

43 |

8 |

10 |

13 |

|

350 – 375 |

42 |

0 |

35 |

5 |

8 |

7 |

|

375 – 400 |

49 |

1 |

42 |

3 |

3 |

4 |

|

400 – 450 |

51 |

5 |

45 |

4 |

5 |

11 |

|

450 – 500 |

35 |

1 |

22 |

0 |

1 |

3 |

|

500+ |

76 |

3 |

70 |

1 |

5 |

1 |

|

Total |

757 |

29 |

601 |

62 |

95 |

101 |

|

Avg. Price |

$330,808. |

$333,293. |

$284,164. |

$294,270. |

$296,293. |

|

|

Days On Market |

59 |

51 |

58 |

55 |

44 |

|

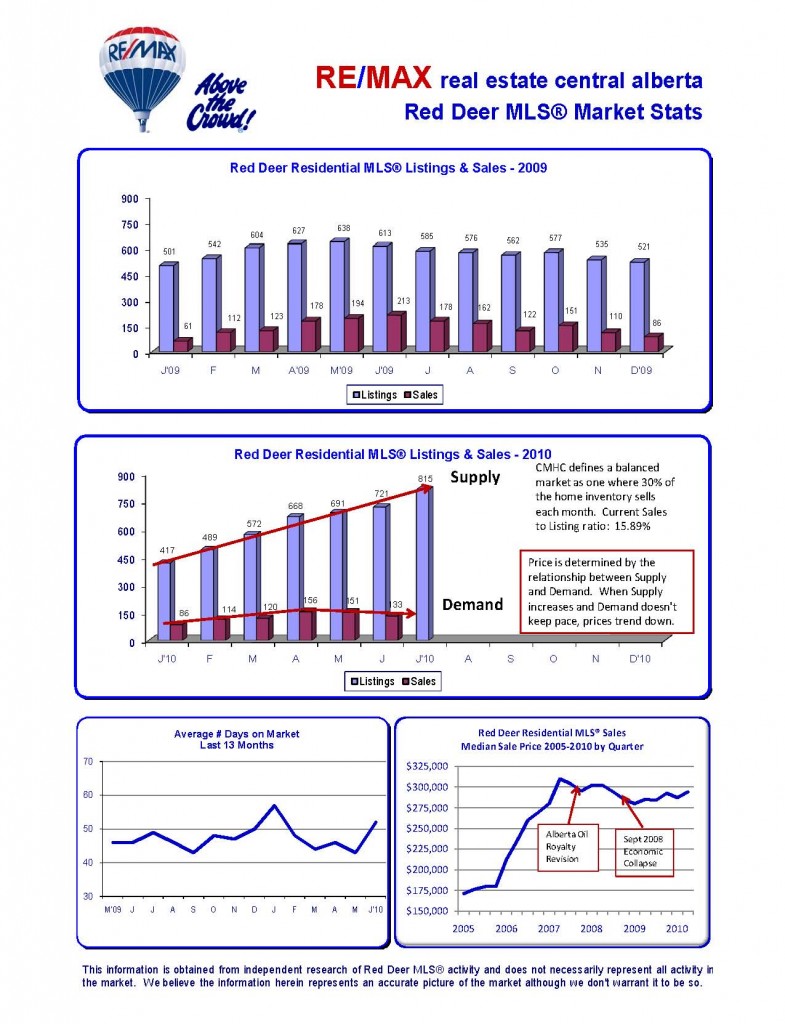

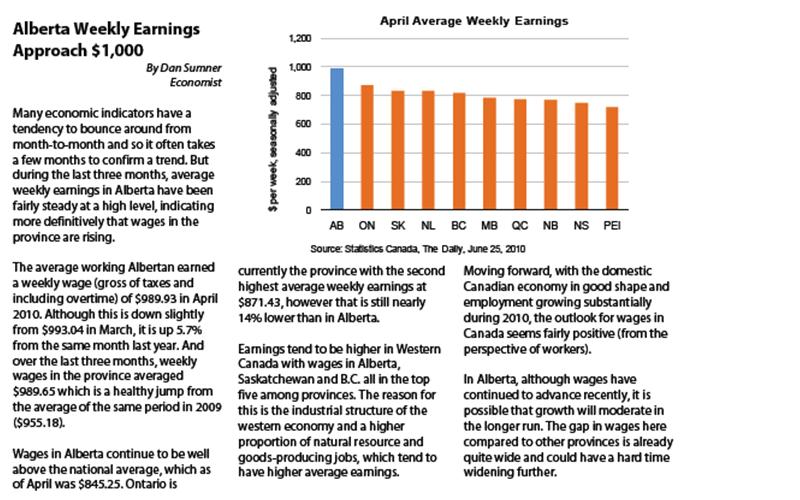

Market Update – The news is full of mixed messages about what is happening locally and around the world. One day the news is good and the next it’s bad. Economists can’t agree on what has happened in the past, let alone what is going to happen in the future. (Let’s face it, if they could accurately predict the future, they wouldn’t be writing economic forecasts). The media happily regurgitate all the stuff they hear from the economists and quite likely don’t get it right a good part of the time.

Unfortunately, bad news seems to sell better than good news so we seem to get a larger proportion of the bad. The problem with continual bad news is it causes consumer confidence to falter. Think about it. If the media prints a prediction that house prices are going to drop by 10% next year, consumers will delay buying homes, waiting for those lower prices. If enough consumers wait to buy, that lower price forecast will almost certainly come true.

People sell their homes because they want a new home, because they want to move to a bigger or smaller home, because they need to move for their jobs, or even because they’ve lost their jobs. People buy homes forthe same reasons.

Those who buy and sell trying to predict the highs and lows in the market are almost certain to miss their timing. Those who wait to sell until the price of their home goes up will pay more for the house they buy. Those who wait to buy their first home until prices go down, may miss the low in the market because no one knows when we’ve hit low until prices start to go up, and then they may pay a higher interest rate which is exactly the same as a higher price.

The moral of the story? Your home is the place where you live and raise your family. Real estate values have always kept pace with inflation. Your home is a great forced savings plan. You can build equity while you provide a roof over your head. Make your housing decisions based on your family’s needs, not on some vague prediction for the future.

The compelling arguments for buying a home today:

Ample supply – we have more homes on the market than at any time in history. A great opportunity to find just the right home for your family.

Low prices – a large supply of homes relative to lower demand has caused very attractive pricing relative to previous years.

Low interest rates – interest rates are at historical lows. Because most home purchases are mortgaged, low interest rates are the equivalent of a large price discount. A difference of two or three percent in the mortgage rate means thousands in savings over the most interest rate sensitive first five years of ownership.

If you are going to sell and then buy again, current price levels are irrelevant, but low interest rates can still be a huge advantage.