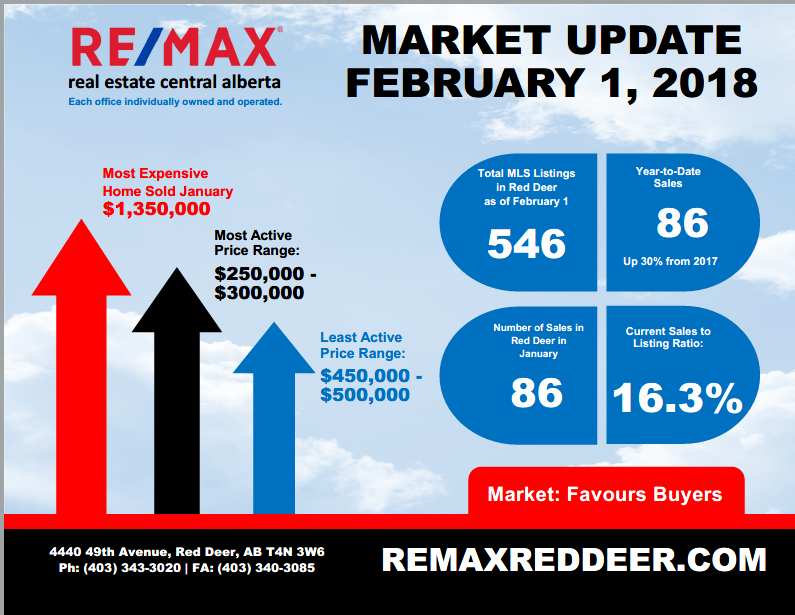

MARKET UPDATE – February 1, 2018

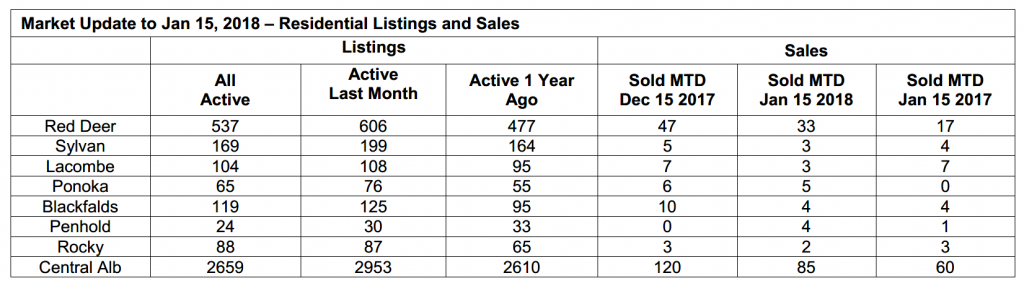

Thursday, February 8th, 2018January sales in Red Deer brought some sunshine into the market, something we don’t usually expect to see until March or April, although the number of active listings remains stubbornly high for this time of year, keeping the demand/supply ratio in buyer’s territory. Some January sales may be the residual of last year’s activity to get ahead of the new mortgage rules, so we’ll have to wait and see what February brings before we declare the market back to normal.

Where is the housing market going in 2018? The provincial government has announced an end to the 3 year recession – very good news, but there are still some challenges lurking, including another potential delay to the Kinder Morgan Pipeline by the BC government. While it’s nice to see West Texas oil trading in the $65US range, Alberta producers are only getting about half that much right now because we have only one customer to sell our oil to – the US. With the likelihood of more delays to that pipeline, capital and equipment are moving south to a friendlier U.S. environment and some of those jobs we had back may disappear.

The Alberta economy runs on energy and will continue to do so for the foreseeable future. The energy industry needs access to new markets to generate investment and the jobs that come with it. Jobs create population growth and wealth. Population growth and wealth creates housing market activity. A quick resolution to the pipeline delay will help get our housing market back on track.