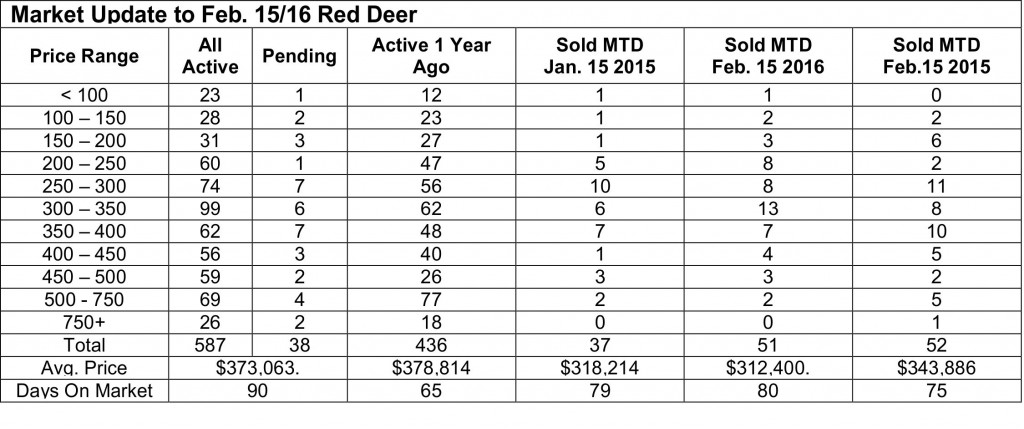

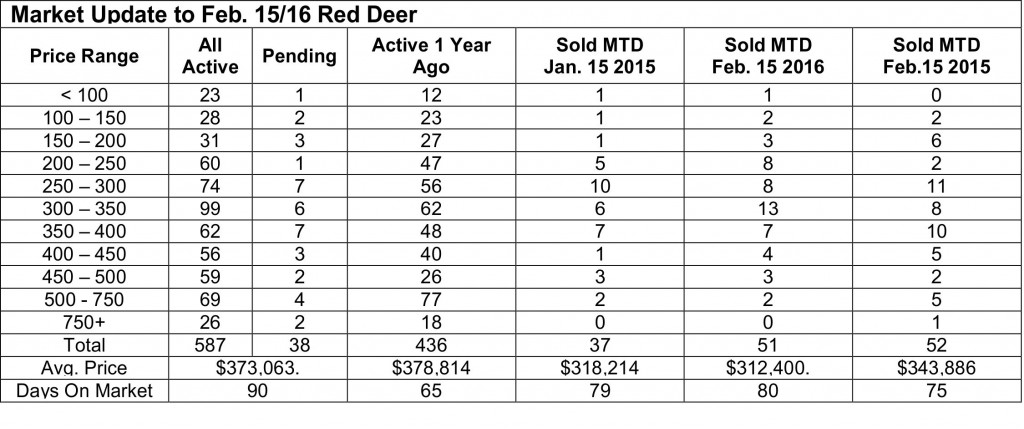

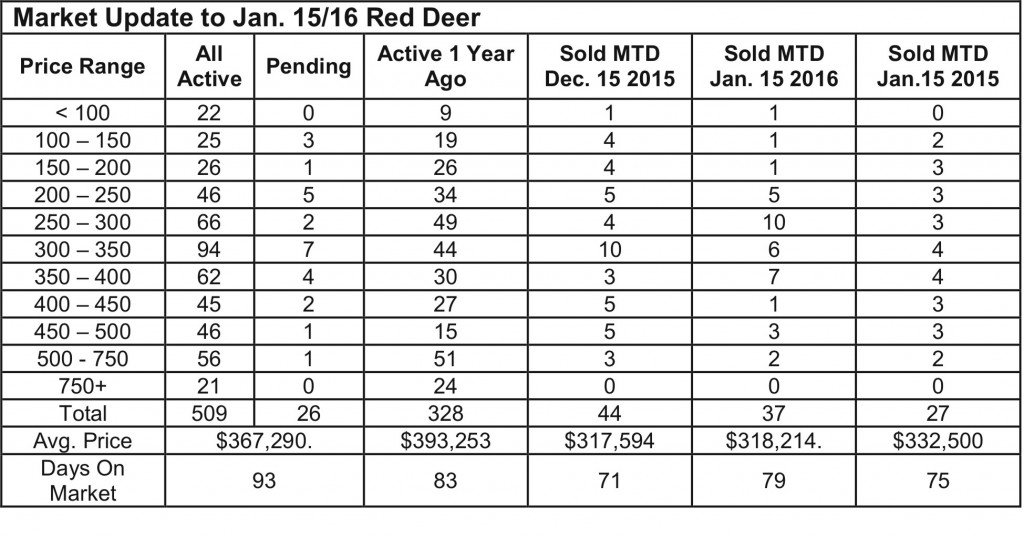

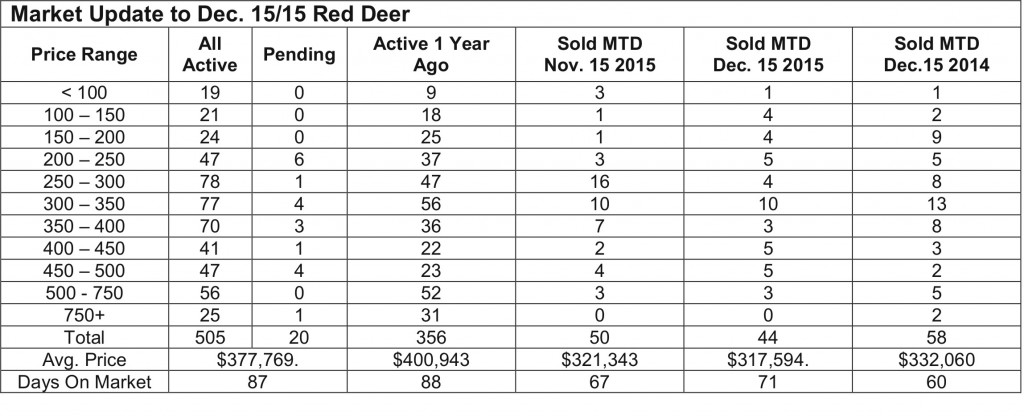

Market Update- Red Deer sales in February kept pace with the same period in 2015 and the pending sales count confirms there is still lots of activity in the Red Deer market. It’s interesting to note that there are sales pending across the price spectrum, with 2 sales pending on homes listed for more than $1,000,000. That suggests confidence in the Red Deer market. The small worry is that the active listing count is much higher than last year at this time.

Sales across central Alberta so far this year appear to be about average when compared with the last five years. The ATB article below does provide a partial explanation. While it does discuss Calgary and Edmonton, central Alberta certainly will be experiencing similar gains. It seems that “bad” in Alberta is just normal in the rest of the country and we are still an attractive destination for people looking for opportunity.

There are other reasons why the market is still behaving relatively normally. Energy accounts for about 25% of Alberta’s economy compared to 35% a couple of decades ago. Some of the rest of the economy outside of energy is benefitting from low energy prices. Some of it is benefitting from the low Canadian dollar. And some is just behaving normally, not affected by low energy prices at all. We don’t want to minimize the pain energy companies and their employees are experiencing, but constantly dwelling on the negative does not help them, or us. Alberta is and always will be in the future a terrific place to live, grow and invest.

Population Growth Still Strong, Rob Roach • Director of Insight, ATB Financial

The latest population estimates from Statistics Canada show that Alberta’s two large metros grew by more than 65,000 people between July 1, 2014 and June 30, 2015. At 2.4 per cent, Calgary and Edmonton tied for second spot on the list of fastest growing Census Metropolitan Areas (CMAs) in the country.

Average growth across all CMAs was 1.2 per cent. Thunder Bay, Peterborough, Saguenay, Sudbury, and Saint John are the five CMAs that saw a reduction in population.

The economic slump has slowed the inflow of both international and interprovincial migrants to Edmonton and Calgary. As a result, their growth rates are down from the previous year. Growth in 2013-14 was 3.5 per cent in both.

Taking a longer view, Calgary and Edmonton have grown by 47.2 per cent and 41.7 per cent since 2001—the fastest growth rates in the country. This translates into 462,000 new Calgarians and 401,000 new Edmontonians over that last decade and a half.

In terms of overall size, Calgary and Edmonton are the fourth and fifth largest CMAs in the country, respectively, and are two of Canada’s six CMAs with populations over one million. With the economic slump continuing into 2016, growth in the two cities will likely continue to slow but still remain among the strongest in the country.