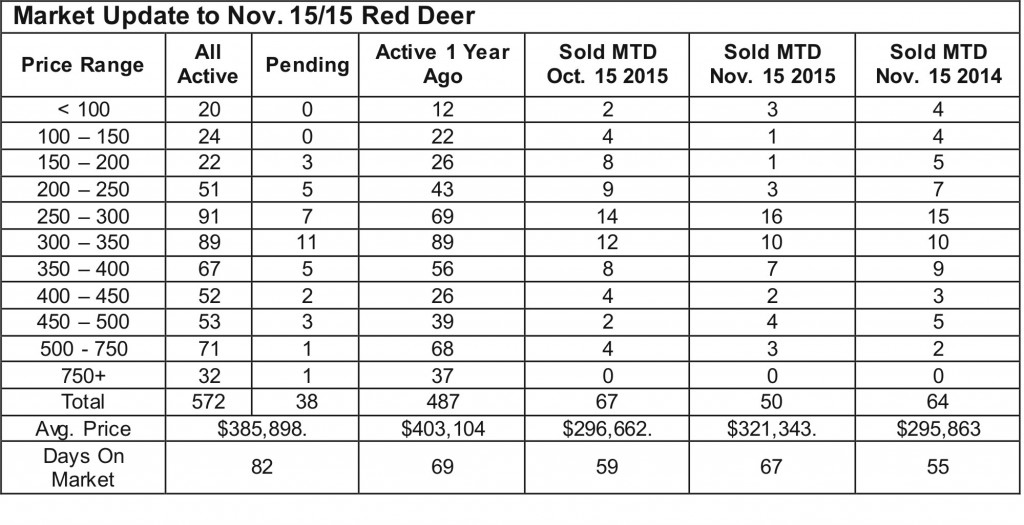

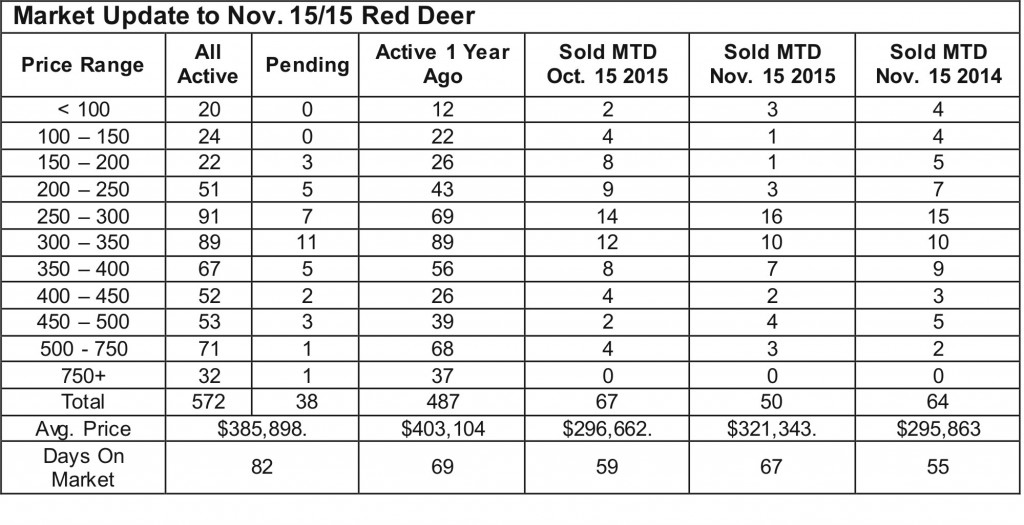

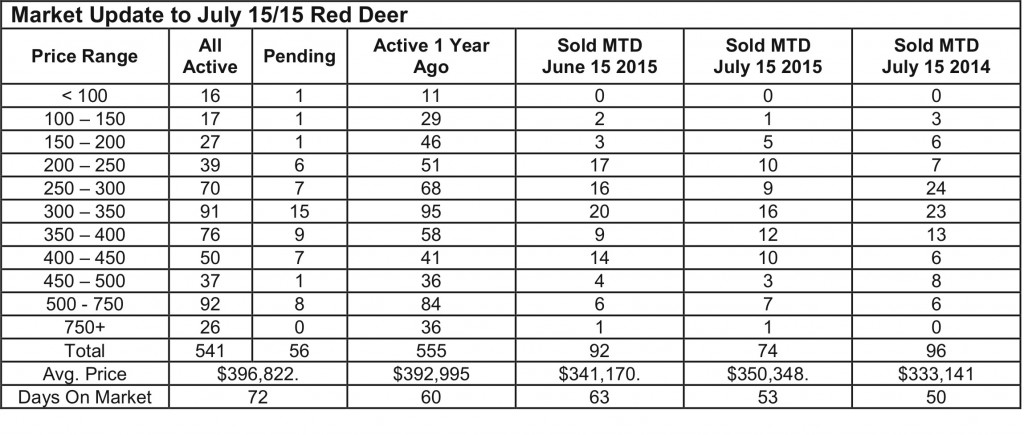

Red Deer sales to the middle of November continued their normal slower trend going into winter and the Christmas season. While sales are lower than last November’s number, they are very average when looking at other years since 2009.

The number of active listings is where it needs to be to provide adequate choices for buyers. This environment creates the perfect opportunity for buyers, especially at the higher end of the price spectrum – great home choices, very low interest rates and stable prices.

Housing starts moderate in October – November 9, 2015 – Todd Hirsch – ATB FinancialHousing starts moderate in October – Nov. 9/15 – Todd Hirsch – ATB Financial

New home builders in Alberta were slightly less busy last month, according to the latest data from the Canada Mortgage and Housing Corporation. Housing starts totaled 31,770 in October (adjusted for seasonality and at an annualized rate—in other words, if builders kept up this same pace for 12 months, that’s the total number of new homes that would be built in one year).

This is one of the lowest monthly numbers over the last two years, a reflection of the slower economy in our province. Still, it would be wrong to exaggerate the slow down as anything too dramatic. Over the last 12 complete months, housing starts have averaged 38,000. That’s only slightly below the average over the previous period of 41,000 (see chart).

The fact that housing starts have pulled back only moderately this year reflects the fact that the market was in a healthy balance before oil prices started to drop. Prior to previous recessions—such as 2008 and 2009—home builders had put far too many new homes onto the market. When the downturn hit, there was a surplus of unsold homes on the market, so construction pulled back more severely.

There’s still a good chance housing starts may slow a bit more towards the end of the year and into 2016. But having gone into the downturn without having built up too much inventory of new homes helped create a good balance. So even if housing starts continue to moderate, they’re unlikely to collapse.

An unchanged new house price index – November 12, 2015 – Nick Ford – ATB Financial

An unchanged new house price index – Nov. 12/15 – Nick Ford – ATB Financial

The price of new homes in Alberta stayed unchanged for the third month in a row, showing further signs that our province’s housing market has softened.

Just released, this morning’s data shows that the index of new homes in Alberta in September remained at 100.1 (based on an index where the average price of a new house in 2007 is set equal to 100). New home prices in Alberta currently sit at the same level as last year, and are essentially the same as they were back in 2007.

The price index for new homes in Calgary in September, sat at 110.4 for the third straight month, while Edmonton’s index remained at 91.5. Since last year, new home prices in Calgary have fallen by about 0.2 per cent. Alberta’s capital is on the other side of zero, prices are about 0.2 per cent higher than a year ago.

As The Owl reported on Monday, housing starts had shown some vigour at the start of the year, but have since started to moderate. And, like housing starts, the new housing price index confirms this moderation.