December 23, 2011 – Weekly Market Report

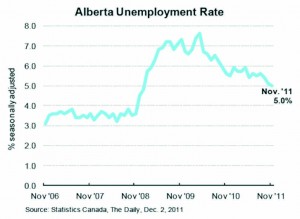

Friday, December 23rd, 2011We have consistently pointed to the United States to predict our fortunes here in Alberta. Lately we have heard a lot of negative news about the US economy, but it appears it is showing some surprising signs of strength lately. Economic growth to the south is good for Alberta. When their economy is moving, they buy large amounts of what we produce. When their economy is moving, their dollar is stronger against ours and those things we sell them are more profitable. Unfortunately, a stronger US dollar makes those trips to the warm south a little more expensive, but it’s

U.S. shows signs of recovery but outlook is still clouded, Barrie Mckenna, Globe and Mail – Dec. 18, 2011

Slowly and surely, the economic colossus is showing signs of recovery. On Thursday, the final estimate of third-quarter gross domestic product is due out, and it will likely confirm the economy is accelerating as the year comes to a close. Economists expect the economy expanded at a roughly two-per-cent clip, following gains of 1.3 per cent in the second quarter and 0.4 per cent in the first.

That’s all in the rearview mirror now. The consensus among economists is for even faster growth in Q4 – perhaps as high as high as 3 per cent.

For the first time in months, several key indicators are pointing in the right direction. Holiday spending is holding up well, exports are picking up, new jobless claims are steadily falling, the economy is adding jobs, consumer confidence is rising and housing is bottoming out.

“U.S.A., U.S.A. – it is interesting that all the talk is now about focusing back on the U.S.A.,” remarked David Rosenberg, the typically downbeat chief economist and strategist at Gluskin Sheff & Associates Inc. in Toronto.

But Mr. Rosenberg isn’t ready to pop the champagne. Dig into the data a bit deeper, and the bounce may not have much lift in 2012. Retailers are discounting like crazy to get shoppers to buy, consumer confidence is still in recession territory and while there are more jobs, wages are stagnating, he pointed out. And several key multinationals, such as Dupont and 3M, are warning of weaker sales in the months ahead.

The “clouded outlook” will force consumers and businesses to save more of every dollar they earn, particularly if Barack Obama is returned to the White House and a big tax grab follows in 2013, according to Mr. Rosenberg. “Barring a pickup in income growth, rising savings rates will come at the expense of spending, which is what GDP is all about,” he said.

Most economists don’t expect U.S. growth to break through 2 per cent in any quarter of 2012. “The U.S. economy faces a challenging backdrop fraught with risks,” according to a 2012 forecast by RBC Dominion Securities Inc.

The key, RBC argues, isn’t the American consumer. Capital expenditures and exports are likely to be the main drivers of the economy, exposing the United States to what is beyond its borders, including a predicted recession in Europe and an Asian slowdown.