April 15, 2012 – Market Report

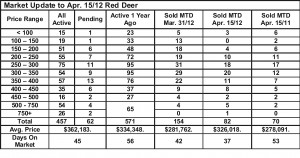

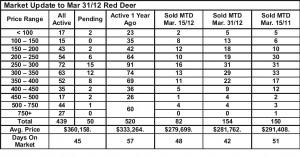

Monday, April 16th, 2012The central Alberta real estate market is holding up well but not booming as might have been predicted based on February activity. Sales in the first half of April are up slightly compared to the same time last year and inventories are down in most markets. Inventories have surprised us a little staying higher than we thought they might, especially in the lower price ranges. Those stable inventories and demand dampened maybe a little by the weather have kept prices stable as well. Very low interest rates still make this a great time to buy.

Alberta Treasury Branches – Weekly Update – Apr. 12/2002

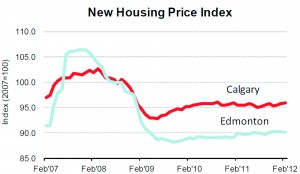

New Home Sale prices steady – Since coming down after the boom the price of new homes in Alberta has been relatively flat. In fact, since 2009 the provincial average new home price has actually dropped 0.5%. Prices move quickly when there’s a sudden disjuncture between supply and demand and this simply hasn’t happened in Alberta in recent years.

Elsewhere in the country builders have been able to raise their asking price. In Toronto the new home price index has risen 10.5% over the past three years. Saskatchewan has also seen new home prices increase rather substantially over the past three years, up 9.3%.

Which way is the U.S. Economy going? Depending on what day you opened the paper the American economy was either strengthening or stagnating. Earlier in the week the Federal Reserve released the results of its beige book. The beige book is a compilation of interviews that are conducted around the country to give a qualitative view of how key industries are doing. The results of the interviews were uniformly positive, with most interviews expanding and hiring at a moderate pace; the only negative was concern over gas prices.

Employment concerns continued to be the downer this week, after last week it was revealed that the economy was adding jobs at a substantially reduced pace. This week it was reported that unemployment benefit claims had risen to a seasonally adjusted 380,000; this was 13,000 higher than the last report, and an unexpected reversal, after having declined for most of the year.

Lastly, Americans have long consumed more than they produced and it’s not going to change overnight, but trade numbers show that the balance is narrowing, going from $52.5 billion in January to a deficit of $46 billion in February.

The trade numbers were actually better than expected, as there was concern that the situation in Europe would have weighed on exports (the EU is the destination of over 20% of U.S. goods). Also helping the trade balance was a reduction in oil imports, as fewer imports are required with U.S. energy production increasing dramatically.