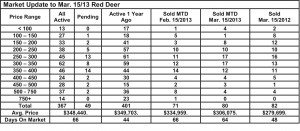

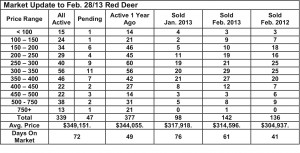

March 15, 2013 – Market Update

Friday, March 22nd, 2013Spring has arrived in central Alberta, at least in the real estate market. While the weather still says “winter”, new listings are coming on the market and buyers are busy snapping the good ones up almost as quickly as they come on. While changes to the mortgage rules seemed to slow the market last summer and fall, interest rates as low as 2.89% for a five year mortgage term are probably helping buyers offset those changes.

The changes to the mortgage rules still seem to be creating some difficulty for first time buyers while low interest rates are benefitting move up buyers. There is the possibility that some first time buyers were frightened out of the market and haven’t figured out the interest rate advantage yet. It’s time they checked again while there are still adequate starter homes available.

Home building in balance – Todd Hirsch, Senior Economist, ATB Financial

There are many words used to describe the Canadian housing sector at the moment, including “bubble,” “overheated” and “dangerous.” Most of those worrisome terms are in reference to residential markets in Toronto and Vancouver. But here in Alberta, the best word to describe the housing market is: balanced.

In February, home builders started construction on 33,337 new houses throughout our province. This figure is seasonally adjusted and reported at annualized rates (i.e., the number of homes that would be built in one calendar year if the current pace continues for 12 months). That’s up from the 29,300 total in January, and mostly on par with activity over the last year.

But over the last five years in Alberta, home builders have been on a bit of a rollercoaster ride. With starts peaking above 50,000 during the heady days of 2008, too many new homes were being placed on the market.

When the economic slowdown came the following year, housing starts tumbled sharply—as did the selling price for both new and existing homes. There was an excess of real estate that caused the much dreaded bubble.

Since that time, things have improved. Even though 2011 was another boom year for Alberta’s economy, home builders showed a bit more constraint— housing starts climbed their way back to the 5-year average, but never spiked too much higher than that.

This time around, builders have avoided a glut of inventory on the market. As a result, Alberta’s housing market enters 2013 in excellent balance.