April 15, 2014 – Market Updates

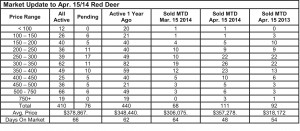

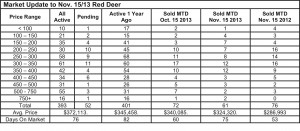

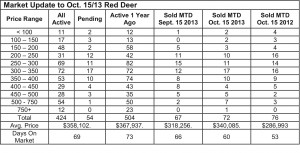

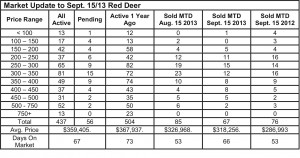

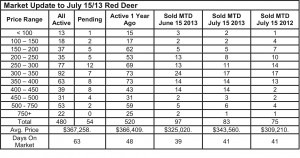

Monday, April 21st, 2014Sales in the first two weeks in April are up 63% compared to the first two weeks of March, while the number of active listings is only up 14%. It’s obvious that the market is heating up and home buyers are facing a tougher job finding the right home. Tough competition in the lower prices ranges is certain to drive prices higher in the coming weeks unless we get a surge of new listings.

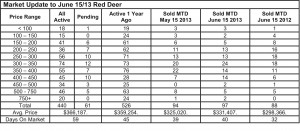

The active market still hasn’t changed – $250,000 – $400,000, although we are starting to see things happen at the high end of the price spectrum – nine sales over $500,000 in the first two weeks of the month, including one over $1 million. Still, the sales to listing ratio on homes over $500,000 is only about 10-15%, in favour of the buyer. We know that many people looking over $500,000 are going to the builders, the same people who buy new cars because they want new and can afford it.

In addition to a huge increase in firm sales so far this month, the number of listings with pending sales is up, effectively reducing the number of homes available to buyers in Red Deer to just 334. Based on current sales, the number of active listings required to keep the market in balance is closer to 500.

According to the Alberta Treasury Branch article below, builders are responding well to the ongoing strong demand for homes across Alberta. We have some concern in central Alberta that the number of serviced lots available for immediate construction is rapidly shrinking while the late spring is hampering servicing of new lots. It appears there could be some shortages of lots this summer until more are serviced. It can take most of our short spring and summer to service a subdivision.

Housing starts keep market in balance, Todd Hirsch, Chief Economist, ATB Financial – Home builders in Alberta geared back up in March after a slight pause in February. According to data compiled from Statistics Canada and the Canada Mortgage and Housing Corporation, construction started on just shy of 40,000 new homes. (This figure is seasonally adjusted and at annualized rates, meaning that if housing starts in March were to continue at the same pace for twelve months, there would be this many new homes started in one complete year.)

Housing construction is one of the most important economic indicators. It provides an excellent barometer of consumer confidence in the province. Alberta’s strong labour market and excellent income levels are giving buyers plenty of reasons to feel confident in their decision.

A good deal of economic activity in other sectors comes from housing construction. New houses stimulate retail and wholesale trade in everything from new flooring and paint to lighting and furniture for the new home. Finally, housing starts employ thousands of workers in the construction sector. Framers, carpenters, electricians, drywallers and landscapers are among the many skilled trade people who depend on new home construction for their livelihood.

Alberta’s strong job market has been a magnet for job seekers and that has added to the demand for housing. The pace of new home construction in March will add to the inventory of new and existing homes, which in some parts of the province (including Calgary) has fallen quite low. New inventory should help keep the supply and demand of houses in good balance.