Red Deer Market Update – Jan 14, 2011

Tuesday, January 18th, 2011| Market Update to Jan. 13/11 Red Deer | ||||||

| Price Range | All

Active |

Pending | Active 1 Year Ago | Sold MTD

Dec. 31/10 |

Sold MTD

Jan. 13/11 |

Sold MTD

Jan. 13/10 |

| < 100 | 20 | 1 | 18 | 6 | 2 | 4 |

| 100 – 150 | 35 | 1 | 28 | 8 | 1 | 1 |

| 150 – 200 | 55 | 3 | 40 | 11 | 0 | 1 |

| 200 – 250 | 67 | 3 | 66 | 14 | 5 | 5 |

| 250 – 300 | 90 | 5 | 82 | 26 | 10 | 7 |

| 300 – 325 | 48 | 5 | 43 | 12 | 1 | 5 |

| 325 – 350 | 28 | 2 | 35 | 7 | 2 | 6 |

| 350 – 375 | 25 | 2 | 23 | 4 | 5 | 0 |

| 375 – 400 | 34 | 3 | 33 | 2 | 1 | 0 |

| 400 – 450 | 37 | 1 | 27 | 6 | 3 | 0 |

| 450 – 500 | 21 | 2 | 20 | 2 | 1 | 1 |

| 500+ | 51 | 4 | 44 | 1 | 0 | 1 |

| Total | 511 | 32 | 459 | 99 | 31 | 31 |

| Avg. Price | $320,722. | $320,979. | $268,818. | $301,516. | $273,500. | |

| Days On Market | 66 | 59 | 62 | 65 | 65 | |

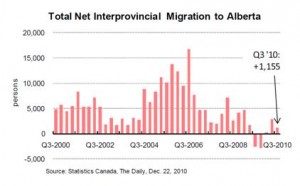

Don’t Just Read The Headline…. the news in the body of this article is really quite positive for Alberta, predicting improved employment growth in 2011. Employment growth means more people working and population growth, which translates to economic well being. Long term economic well being creates a strong housing market.

For first time buyers, it appears that now is an opportune time to make your move to home ownership. We do believe that there will be a very good selection of homes to buy this spring and combined with fantastic mortgage rates, makes this best time to buy. If you are considering moving up, that great selection and the interest rate advantage applies to you as well.

Alberta Firms Reluctant to Add to Payrolls – by Dan Sumner, Economist ATB Financial

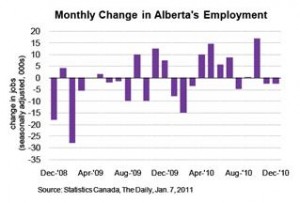

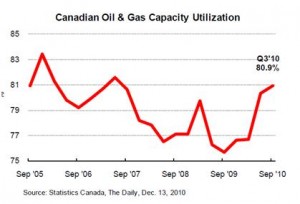

Alberta’s economy showed strong signs of life in the fourth quarter of 2010, with nearly all economic indicators pointing to the upside. However, when it comes to employment, firms have only reluctantly added to payrolls.

Total employment in Alberta shrank by 2,400 jobs in the final month of 2010, while the unemployment rate moved sideways at 5.6%. December’s reading was the second consecutive month of flat employment after seeing a big gain in October.

Digging deeper into the data shows a generally lacklustre report with a gain of 3,100 part-time jobs more than offset by a loss of 5,500 full time positions. Alberta’s mighty energy sector saw strong job growth (+6,100) along with profession scientific and technical category (+13,300), which includes things like engineers, geologists and lawyers.

Interestingly, over the past year the forestry, mining and oil and gas category has seen the strongest job growth of any industry, adding nearly 30,000 jobs. Considering the energy sector is the base for so many other parts of Alberta’s economy, this could spell good news for jobs in 2011.

Nationally, the jobs report was slightly more optimistic with Canadian employers adding 20,000 jobs in December. Over the last few months employment growth has slowed down markedly from earlier in the year, although has managed to stay positive.

Employment in Alberta, which lagged behind momentum seen at the national level during 2010, is still just below its pre-recession peak. Looking into 2011, with the oil sector benefiting from strong prices and the economy generally moving in the right direction, it is likely that Alberta will finally regain all the jobs that were lost to the recession.