October 5, 2012 – Market Update

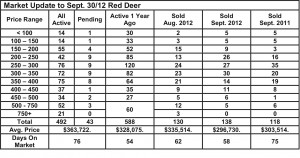

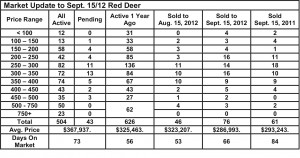

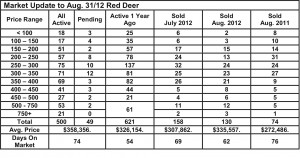

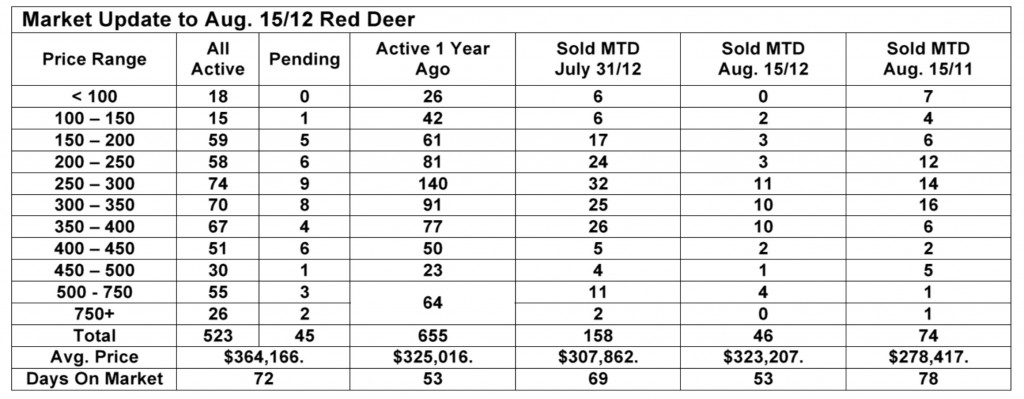

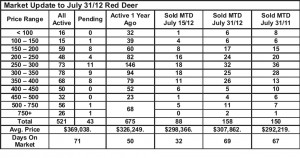

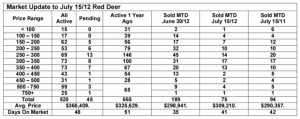

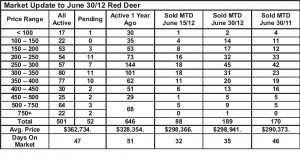

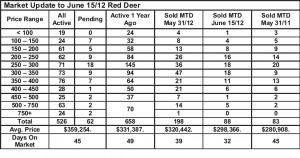

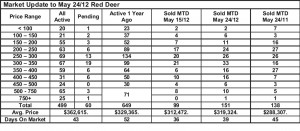

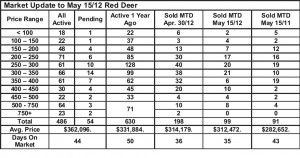

Friday, October 5th, 2012Red Deer sales were up slightly over August’s while our active listing inventory slipped slightly. The ratio between Supply and Demand for homes in Red Deer is just under the 30% mark which means we are close to being in balance – where neither the Seller or Buyer has an advantage.

The overall central Alberta market has improved over August’s. The market has recovered from a slower August that we suspected may have been caused by changes to the mortgage rules. The stronger September market may have been caused by tenants turned first time buyers escaping rising rents and a shortage of rental accommodations. The number of active listings is generally lower than last year, bringing the sales to listing ratio closer to balance, but still in Buyer’s market territory in most markets.

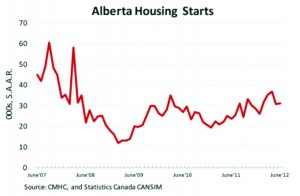

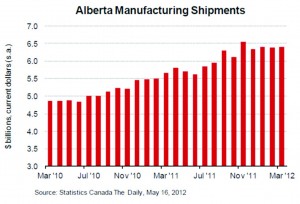

That means that prices will remain stable for the near future and won’t increase until that ratio gets well above 25%. The possibility that could happen in the next few months seems very real, based on the Alberta population growth information below. The stabilizing factor is new housing. As people move to Alberta, new houses are built and as long as the construction industry can keep up, housing supply and demand will remain in balance.

Excerpts from Alberta Treasury Branch – Weekly Economic Bulletin – Sept 28/2012

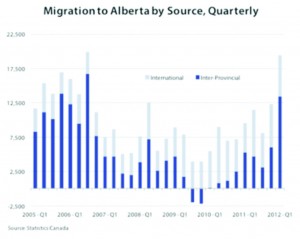

Alberta bound – Statistics Canada came out with population estimates this week for the period of June 2011 to 2012, showing

that Canada’s population hit 34.9 million people. This was mostly thanks to immigration, at 260,000 people. For the past decade, Canada has been accepting between 240,000 and 270,000 immigrants annually, a rate that is the main reason the population is increasing. The natural rate of population growth (births minus deaths) has been in the range of 130,000 to 140,000 over the same period.

Alberta’s population continues to not only grow the fastest in the nation, increasing 2.5 per cent (the national average was 1.1 per cent), but also remains the youngest, with a median age of 36.1 years (the national average age is 40). As well, interprovincial migration picked up over the period, with 28,000 Canadians relocating to Alberta. International migration also picked up substantially, hitting a record 34,500 individuals.

And Alberta inbound – Given that Ontario is by far the largest province in Canada by population, it’s not surprising that it also

provides the bulk of Alberta’s inter-provincial migrants. Last year 10,700 Ontarians got on the Trans-Canada highway and headed west. In contrast, net-migration from Saskatchewan, historically a major source of labour in Alberta, was very low, at 454 individuals.

Contrary to popular belief, neither Atlantic Canada nor Saskatchewan has contributed the most to Alberta’s net gain in population. Over the past decade Alberta’s net balance of population with Ontario increased 91,000, which is more than the number of the combined increase from Atlantic Canada and Saskatchewan (at 52,500 and 24,600, respectively).

Regardless of an individual’s place of origin, the human pipeline to Alberta represents good news for the local real estate markets, as these new Albertans need to be housed, and for the provincial labour market, as it keeps things from overheating too quickly.