January 2012 – Market Update

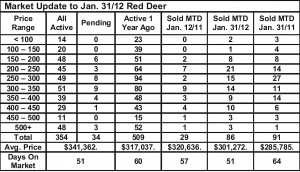

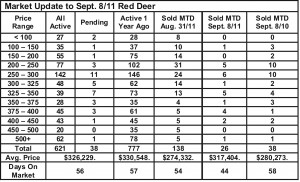

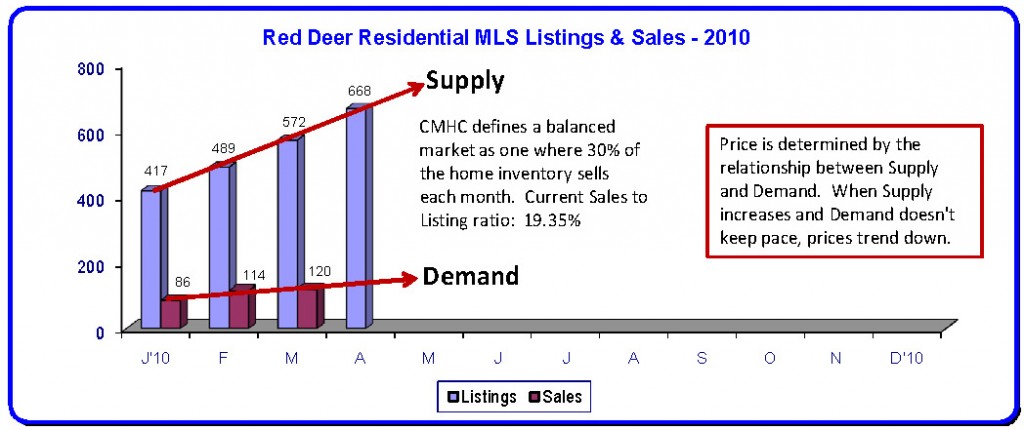

Monday, February 6th, 2012We’ve just experienced one of the best January’s in recent history. Sales are up in every market we serve and listing inventories are not increasing the way they usually do at this time of year.

Two key factors are driving the change we’ve experienced over the last few months:

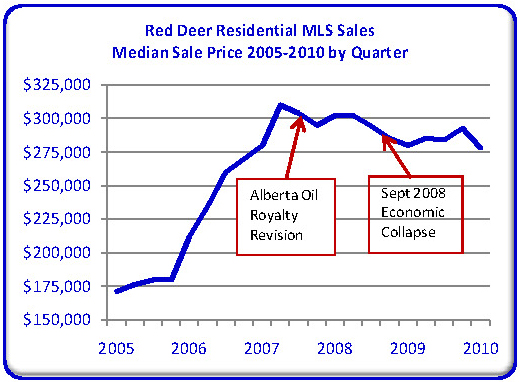

Interest rates – Investors and banks have cash and very few safe places to invest it. One of those safe places is bonds. When everyone wants to buy bonds, the yield goes down. Lower bond yields pushes investors to other options like mortgages. Several major banks have put mortgages “on sale” this month at rates as low as 2.99% for a five year term. Rates that low are unprecedented in our history and make buying a home more affordable than ever. The benefit of low rates will be most effective until home prices start to inflate, which they almost surely will as the gap between supply and demand narrows.

Oil prices – there is estimated to be more than 15 billion barrels of oil trapped in shale along the Alberta foothills that has previously been unavailable using conventional drilling methods. Now, horizontal drilling and a process called fracking is making an estimated 5 billion of those barrels available and the race is on. Central Alberta is a major centre for fracking companies who are looking for workers.

Development in the Alberta oil sands is progressing at full speed and will continue to do so as long as oil prices remain above $75/barrel. The demand for workers far outstrips supply. Workers are no longer required to live in Ft. McMurray, but are commuting from all over Canada, including central Alberta.

The Alberta oil sands development has also resulted in manufacturing operations in central Alberta that are very busy fabricating equipment and many of the other necessities required for remote operations. Lots of people in central Alberta are directly employed by the oil sands but never make the trip up there.

The energy industry is very busy creating jobs. Alberta has the lowest unemployment rate and the highest average weekly wages in Canada. People are once again moving to Alberta, filling up the available rental accommodations and generating housing demand. As long as oil prices remain high, that demand will grow.

Forecast – it’s impossible to predict the future, but if the current trend continues, we can expect to see house prices firming up this spring. Obviously the world economy is tenuous and we will be affected by things that happen in the rest of the world, especially the United States. It’s hard to believe the US economy will be running on all cylinders any time soon, but there have been some positive growth signs recently that suggest things are getting slightly better.

Economic growth in the US has the potential to drive the value of the Canadian dollar down, which is very good for our provincial government. A lower Canadian dollar dramatically increases government revenue here. 95% of Alberta exports go to the United States and a stronger economy there, means more jobs and more economic activity.

Therefore, we expect to see a very busy real estate market in central Alberta this spring.