December 15, 2012 – Market Update

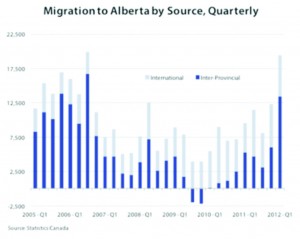

January 2nd, 2013A familiar refrain at this time of year – listings are down. Very normal considering most folks don’t want to be bothered with showings over the holiday season. The difference this year is that they are down more than the last few years and, there are more buyers out there than usual as folks continue to move to Alberta for all those great paying energy sector jobs. It’s quite possible that those looking to sell after Christmas might be best served by jumping right into the market rather than waiting until spring when there will be more competition.

Excerpts from the ATB Economic Comment by Todd Hirsch and Will Van’t Weld

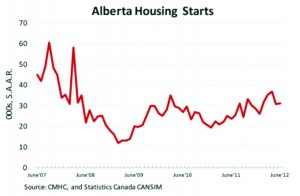

Steady housing market – There were continued signs Alberta’s housing market is in relatively good shape. Nationally, urban housing starts dipped slightly in November to a seasonally adjusted 174,000, which is a pretty significant drop from the 200,000-unit pace Canada has been building at for much of 2012. Alberta, on the other hand, recorded the second highest housing start figure of the year at 35,500.

New housing price index data were also released this week. Since 2011, the national year-over-year monthly growth rate has been a steady 2.27 per cent, but this hides some important variation between provinces. In Ontario, the rate averaged 3.89 per cent; Alberta’s growth rate averaged just 0.73 per cent; and in B.C. it averaged -0.6 per cent.

Recently, Alberta’s rate of growth has quickened, rising by 1.62 per cent in October over 2011, but in Ontario and B.C. the rate has remained relatively constant.

Sticker shock? Not so much for new homes – Fresh paint, new appliances, shiny bathrooms— there’s plenty of appeal to owning a brand new home. And consistent with the currently balanced real estate market in Alberta, the price tags on these newly built abodes remain steady.

In October, the price index on a new home in Alberta stood at 94.2—up only modestly from 94.1 in September. The index is based on new home prices in 2007. Setting that price to an index of 100, the price of new homes in Alberta fell by about 10 per cent during 2008, and has been almost unchanged since then. Calgary’s new home price index in October (98.0) is higher than Edmonton’s (90.8), but both cities remain below the price level five years ago.

Compared to our neighbouring provinces, the new home market in Alberta is still lagging. In British Columbia, the price index of 98.8 is slightly higher than Alberta’s—but it has been trending gradually downward since early 2010.

Saskatchewan is a completely different story. New home prices did wobble during the economic downturn, but have been rising steadily since then. In October 2012, the index in that province stood at 134.0—suggesting prices today are higher by more than a third compared to 2007.

Prices in Saskatchewan have risen more quickly than in Alberta, but the index does not compare the absolute price tag across provinces. Saskatchewan’s home prices are still only catching up to the much higher values in Alberta and British Columbia.