June 30, 2012 – Market Update

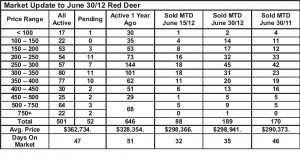

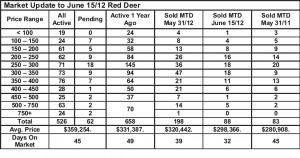

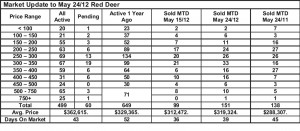

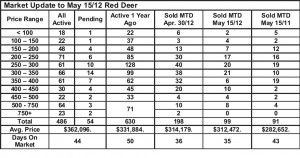

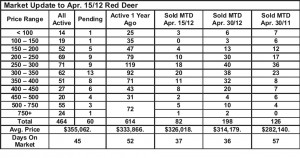

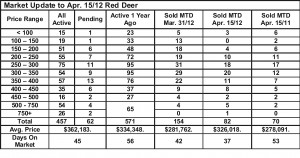

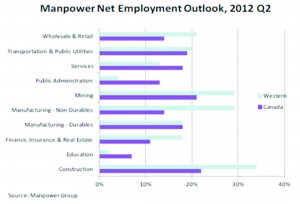

July 6th, 2012Market Update – The central Alberta real estate market is moving along nicely, although demand has leveled off since early spring. Lacombe, Sylvan Lake and Ponoka remain over supplied with sales to listings ratios that give the advantage to buyers. Red Deer and Blackfalds markets remain solidly in seller market territory with sales to listing ratios in June of 37.5% and 33% respectively.

Year to date sales of all types of residential properties in central Alberta are up almost 20% this year compared to 2011. There are signs that prices have leveled off in all markets, and even increased slightly in as the gap between sales and listings has narrowed.

Excerpts from: Mortgages: 25 to 40 and back to 25 in 6 years – Will van’t Veld, ATB Financial

It turned out to be a brief flirtation. In 2006, 40 year amortization periods were introduced, now, six short years later, the standard amortization period on a home loan is returning to 25 years. Much of this is being driven by a desire to cool a housing market without touching interest rates (that influence the entire economy). But there are differences worth highlighting between how interest rates and altering credit conditions influence the demand for housing.

Real-estate is a unique good. It’s the largest investment a household is likely ever to make. The return the household gets from that investment is shelter—which as a necessity of life—and would have to be purchased in any respect in the form of rent. Giving Canadians the option to get into the property market instead of renting or having to wait to upgrade their living conditions, was no doubt the primary motivation behind the lengthening of the traditional amortization period.

Opting for a longer amortization period wasn’t cheap. Not only did it cost the mortgage holder a higher upfront free, but it also represented tens of thousands more in interest payments. Households were offered higher credit than they’d normally be offered—but it came at a cost to borrowers—and lenders still had to do their due diligence. Underwriting standards weren’t reduced, as they were in the United States, but the credit limit was increased. ……

Clearly the move to 40 year amortizations likely stimulated demand far more than anticipated, as no one in 2006 was equating longer amortization periods as an alternative to lowering interest rate to stimulate demand just for housing (i.e. the flip of today’s argument for going back to 25).

There’s a big difference between how changes to amortization periods might impact housing demand and the impact that lower interest rates has on the demand for housing. The former is truly a trade-off of higher current housing consumption or investment versus higher total interest and other costs, whereas the latter doesn’t entail any kind of trade off, it’s just cheaper or more expensive.

Take the impact of the recently announced shortening of amortization periods. The monthly payment on a $350,000 mortgage at four per cent increased $176 by lowering the amortization 5 years, but it saved the borrower about $47 thousand in total interest. The equivalent jump in monthly payments, keeping an amortization period constant, could be obtained by seeing mortgage rates increase 85 basis points. In this case, instead of seeing the all-in cost of the house decline it actually increases by a total of $63 thousand. …….. Some wind will certainly be taken out of the home buyer market, especially at the margins with first-time homebuyers, but it was a prudent move.