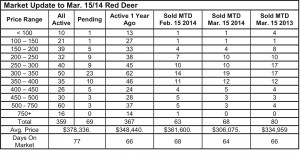

March 15, 2014 – Market Update

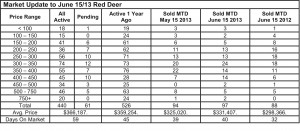

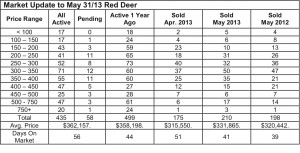

Monday, April 7th, 2014Sales in the first two weeks in March were up a little from the same time in February and well down from the same time last year. New listings are coming on the market at a brisk pace and inventories are almost at last year’s levels. It feels like it has been busier than the number of sales would suggest and the number of pending sales supports that feeling at the highest level we’ve ever seen.

As usual, most of the activity is in the $200,000 – $400,000 price range where every third house on the market has a sale pending. At that pace of sales, there is bound to be listing shortages heading into the spring market.

All the good news in Alberta, especially when it comes to job creation, will almost certainly keep attracting large numbers of people to come here from the rest of Canada. Population growth fuels the housing market like nothing else.

Alberta’s Job Market Revs Up – Todd Hirsch, Chief Economist, ATB Financial – February’s job report puts to rest any lingering notions that Alberta’s labour market is shifting into lower gear. If anything, it may sound the alarm that the economy is galloping ahead too quickly. Last month, Alberta saw an increase of 18,800 new jobs (adjusted for seasonality)—the highest pace of monthly job creation in nearly three years, and well above the average gain of about 6,000 since the end of the 2009 recession.

The unemployment rate also dropped three-tenths of a percentage point to 4.3 per cent. The extraordinary performance in February brings the 12-month increase up 3.8 per cent to 82,300. Alberta now accounts for 87 per cent of all the jobs created in the entire country since February of last year.

Most of the new jobs in Alberta were in construction (+23,300), retail and wholesale trade (+7,300), and oil and gas (+6,800). These gains were partially offset by a drop in professional, scientific and technical occupations (-15,200), and health care and social assistance (-10,600). Three months ago, Alberta saw a one-month drop of nearly 10,000 jobs. That led to some concern about an economic slowdown. The longer term trend points to anything but. With a falling unemployment rate and employment rising more quickly than the pool of available workers, the true worry could be that more Alberta employers will feel the pinch of labour shortages.

Trade deal good news for Alberta – Todd Hirsch, Chief Economist, ATB Financial – Canada’s new free trade deal with South Korea could be hugely beneficial to exporters, including those from Alberta. Prime Minister Stephen Harper signed the deal earlier this week.

With a population of more than 50 million, South Korea is nearly 50 per cent larger than Canada (population 35 million). Alberta has exported $2.9 billion in products to South Korea over the last five years—a miniscule amount when you consider total global exports over that period equalled $443.9 billion. But Koreans are becoming increasingly affluent and sophisticated, presenting Alberta exporters with lucrative opportunities.

The largest category of exports over the most recent five year period was natural resource products, notably coal and wood pulp (see graph). Machinery and mechanical appliances also made up a sizable portion (16.6 per cent). The big winners to come from the trade deal are Canadian farmers. Wheat and cereal grains make up more than 12 per cent of exports. Meat products account for another six per cent. Up until now, meat has faced high tariffs going into South Korea. With those trade barriers removed, Alberta farmers will be able to increase the volume of meat and other agricultural products they export overseas.