May 15, 2013 – Market Update

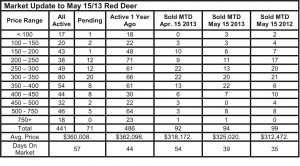

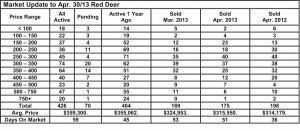

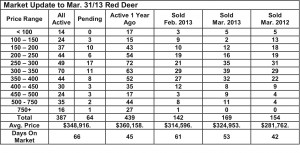

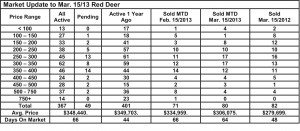

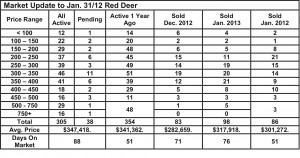

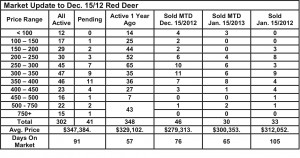

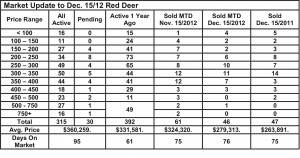

Wednesday, May 22nd, 2013The real estate market across central Alberta continues to hum with very strong sales, but as indicated below, supply so far is keeping up with demand which will go a long way to keeping things in balance. While the number of listings is not quite as high as last year, there seems to be adequate inventories to satisfy demand. Prices have definitely firmed up, but they aren’t rapidly escalating which is great for the long term good of the market.

While sellers feel great when the value of their real estate rises, it often doesn’t help once they sell and become buyers because now they have to pay those same relatively higher prices for the home they are buying.

A strong, balanced market is the ideal situation and we seem to be currently there in central Alberta except for Ponoka where buyers still have the advantage. We expect the Ponoka market to start to benefit from strong demand elsewhere in central Alberta this year.

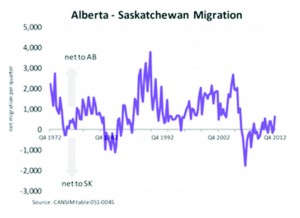

The reasons for our strong market remain the same – strong oil and gas activity, expansion of the Nova plant at Joffre, affordable housing costs relative to incomes, very low interest rates and lots of in-migration to Alberta as a result of strong job market and high wages.

Accommodating the Alberta bound by Will van’t Veld, Economist, ATB Financial

There’s a reason why Calgary’s CTrain has been feeling more congested lately: people have been flocking to Alberta. Not since the boom years have so many people arrived in our province—and if the pace keeps up it will have important implications for the local economy.

That people are coming to Alberta shouldn’t be a surprise. In fact, it’s slightly more surprising that it took until the first quarter of 2012 to see the numbers really spike. The unemployment rate is not only well below the national average, but wages have been steadily climbing. In fact, the average weekly wage in Alberta is now $156 higher than in Ontario.

While migrants from other provinces have recently shown more interest in our province, the upward trend in international migration has been occurring since the recession hit. Alberta gained about six thousand migrants due to international migration in the first quarter, almost double what the province was recording just five years ago.

The tremendous influx of people during the boom years caused a severe shortage of housing and other social services.

So far, Alberta’s infrastructure and housing stock appears more prepared to accommodate the growing population.

There’s a good reason for this, as housing starts, for instance, might have dipped during the past couple years, they didn’t fall off of a cliff either. Major infrastructure projects also continued to go ahead.

With companies actively recruiting out of province workers, both nationally and internationally, and the prosperity gap still heavily in Alberta’s favour, there’s a good chance more people will be Alberta bound in the coming quarters. At a certain point it may strain our ability to accommodate them, but so far so good.