December 16, 2011 – Weekly Market Report

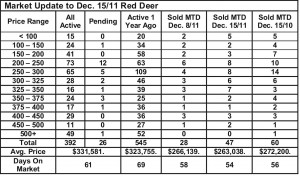

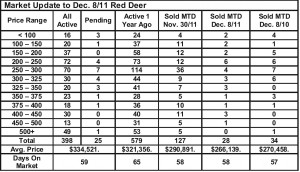

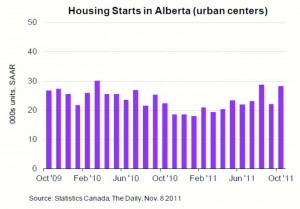

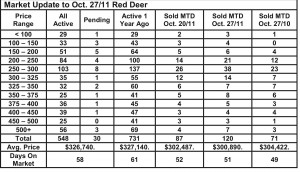

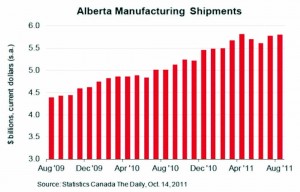

Friday, December 16th, 2011Only in Alberta – Imagine! Provincial employment in Alberta is up 97,000 jobs in the last 12 months! The impact that is having on our economy is visible in our local housing market as demand for rentals is up, vacancies are down and the housing inventory is shrinking.

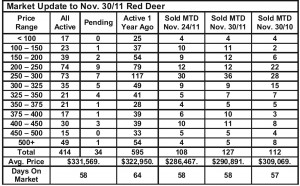

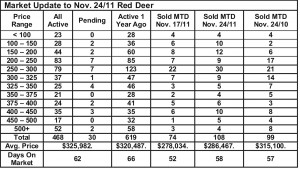

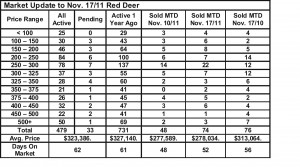

It’s too early to be predicting much in the way of price increases, but it appears that the market is definitely stabilizing and demand is the strongest it’s been in years. The reason we aren’t predicting price inflation is that builders and developers appear well prepared to quickly add to the supply of homes, thus keeping supply and demand in balance.

Balanced Job Market – by Todd Hirsch, Senior Economist – Alberta Treasury Branch

The last official jobs report of 2011 disappointed on the national front, but in Alberta the news was once again quite encouraging.

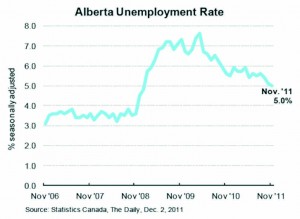

For the seventh consecutive month, Alberta saw an increase in total employment, rising by 4,500 jobs. Compared to twelve months ago, provincial employment is up by over 97,000 (+4.8%). Alberta’s unemployment rate fell to 5.0%—the lowest in the country, and close to the point generally considered a balanced job market.

Canada’s national job market, on the other hand, unexpectedly shed 18,600 jobs in November. That was opposite the expected gain of about 12,000. Job losses were concentrated in Quebec and Saskatchewan. The national unemployment rate edged higher to 7.4% in November, up from 7.3% in October.

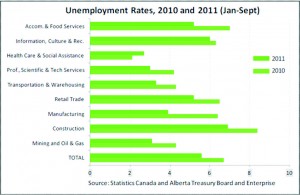

Even better news for Alberta, there was a strong shift towards full-time work (+9,100), while part-time positions actually fell (-4,600). Strong gains in oil and gas (+8,900) and other services (+11,600) were partially offset by losses in trade (-8,400) and manufacturing (-8,000).

While Alberta continues to buck the national trend in the jobs market, the pace of provincial job creation over the past several months has slowed. With the rate of unemployment being balanced—and increasing worry mounting in the global economy (see Economically Speaking)—Alberta is likely to see some moderation in employment growth in 2012.

But even with slower job creation, the province’s labour market will remain in enviably good shape.