August 19, 2011 – Weekly Market Update

Friday, August 19th, 2011We all know that oil and gas exploration and production form a very large and important part of the central Alberta economy and the price of oil and gas dictate the amount of activity our local energy industry participates in.

Any time the world economy falters, oil and gas prices are affected. It’s a constant guessing game to know where prices will be next week and next year.

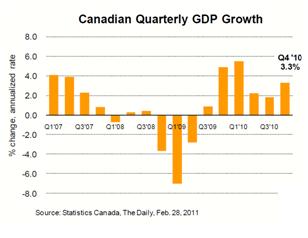

Fortunately, the last couple of paragraphs below offer some hope for continued stable prices and therefore a stable local economy.

Oil Price Swing by Todd Hirsch, Senior Economist, ATB

Albertans are used to watching the price of crude oil rise and fall, but even seasoned veterans of the oilpatch were paying attention to the wild price gyrations witnessed this week.

Based on the price of West Texas Intermediate crude, a benchmark commodity traded and priced on the NYMEX, oil prices have fallen nearly 20% over the past few months. After hitting a recent high of $US 113 per barrel back in April, this week oil fell to below $US 80. If prices stayed below this point for a long period of time, some of Alberta’s oilsands projects may be reconsidered—or possibly shelved.

Behind this recent price volatility are several factors. The downgrade on US government credit sent shockwaves through markets all around the world, including stock markets and commodities. Oil was one of the casualties (although gold hit record highs).

Also, revisions to US economic data show that the 2008 recession was far deeper than first thought. And numbers for 2011 are not encour-aging. The prospect of another recession in the US economy helped push oil prices lower.

By the end of this week, oil prices had recovered to above $US 86 per barrel (at noon trading). The volatility in stock and commodity prices this week is not necessarily being driven by market fundamentals, but rather by fear and uncertainty. That will subside.

On the supply side, nothing has changed. Oil is still costly to dig out of the ground. And emerging economies such as China and India still need plenty of oil (for now, at least). This suggests that once this recent bout of market volatility calms down, oil prices will calm down too, and should continue trading between $80-$100 over the coming months.