October 7, 2011 – Weekly Market Update

Friday, October 7th, 2011Central Alberta Market Update – Sept 30, 2010

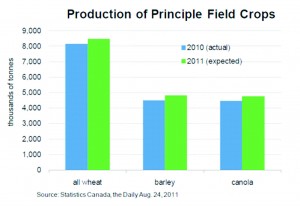

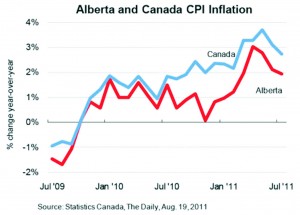

We’ve seen lots of good economic news in Alberta this year and it’s evident in an improved real estate market in central Alberta. MLS sales from Jan 1, 2011 to Sept. 30 for the area served by the Central Alberta Realtor’s Association are up over the same period in 2010 by 18.27% and that number is generally reflected in most of the municipalities we service with the exceptions of Sylvan Lake (0% change) and Lacombe (+8.4%).

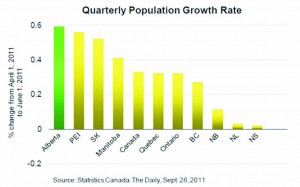

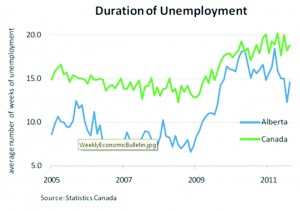

The biggest reason for the improvement lies in the population growth identified below. People go where the jobs are and Alberta seems to have the best job creation record in the country at the moment.

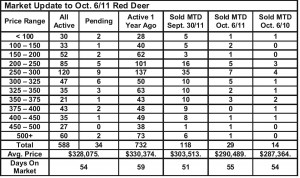

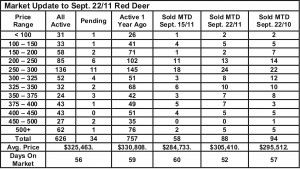

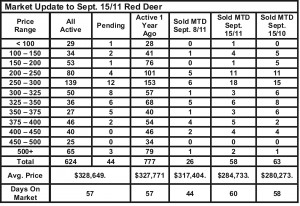

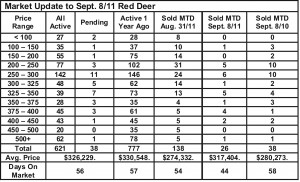

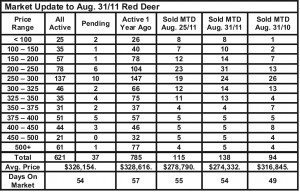

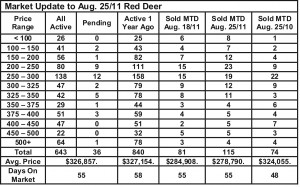

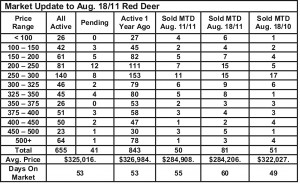

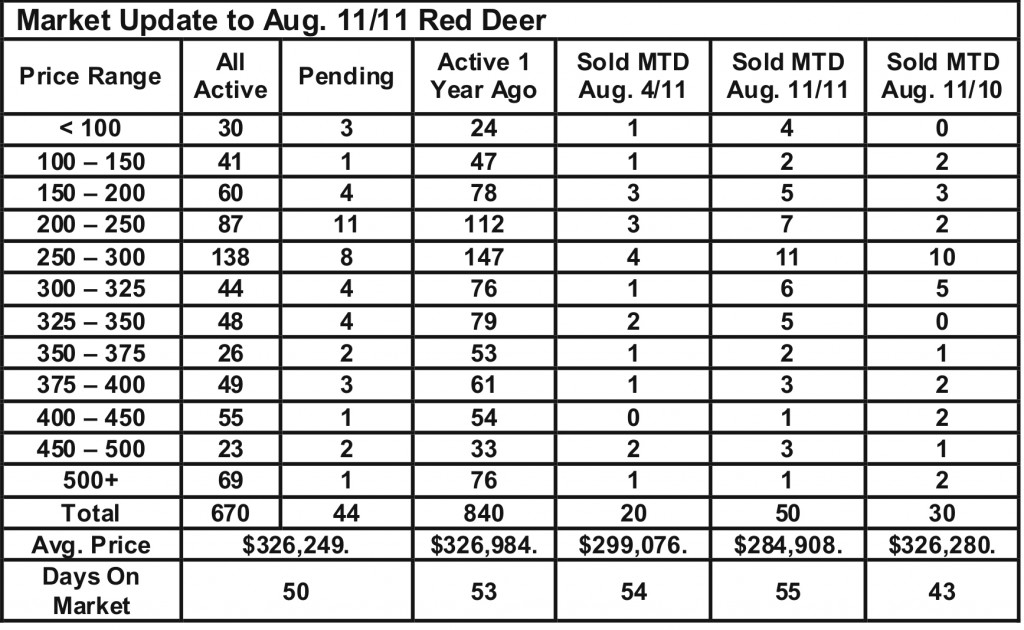

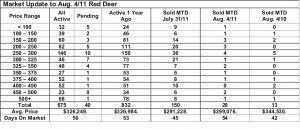

While sales are up, the relationship between supply and demand hasn’t improved enough to cause prices to change. In fact, prices could be down a little at the middle to high end of the price spectrum since last year. Supply and demand balances vary by price range and the low end of the price spectrum is much closer to balance than the high end.

Growing Population – ATB Financial – Weekly Economic Bulletin – Sept. 30/11

Alberta’s population numbers shot up in Q2 2011, according to new Statistics Canada data released this week. The overall provincial population grew by 0.59% in the second quarter, the highest rate since the fourth quarter of 2008. The main driver behind the surge in population growth was a jump in net-international migrants to 8,313, up from only 3,708 in Q1. The province also saw strong levels of interprovincial migration with 4,720 Canadians moving here. Natural increase (births minus deaths) added another 8,190 new Albertans.

A growing population is one of the main factors driving the Alberta economy forward. During the boom years, Alberta’s population grew by as much 99,000 people per year, while even in 2008 and 2009 (which were not strong years economically) the province welcomed nearly 80,000 new residents. The rising population helps fuel growth in a wide range of industries including construction, retail and housing.