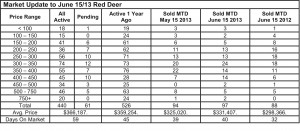

June 15, 2013 – Market Update

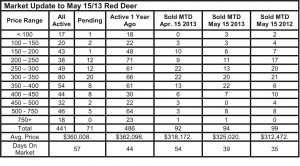

June 27th, 2013The central Alberta real estate market continues to chug along. Sales in the first half of June are down from May’s and off slightly from last June. Historically June has been a slower month coming off our strong spring markets and we believe it’s because families are typically very busy in June with school year ending activities and just have less time to spend on looking at homes. Typically, June has also been the end of spring break-up in the energy industry, marking the time those workers are back to work with less time to think about looking at homes.

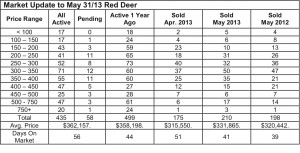

Of course, there are many very complicated factors that affect the local and world economies and therefore the local real estate market. That makes it very difficult to predict what comes next, but historically the market slows some going into the summer months and will pick up again in the fall. Right now it appears that the market is close to balance with adequate inventories in most price ranges and reasonably strong demand as people continue to move to Alberta.

The biggest reason we continue to have adequate inventories is very strong activity in home construction as indicated in the article below. Quite simply, at this point anyway, the builders are keeping up with demand and we are looking for a “normal” summer and fall market.

Housing starts hit five-year high – Todd Hirsch, Chief Economist, ATB Financial

While softer energy prices may be moderating overall economic growth this year, it appears that homebuilders didn’t receive the memo. Judging by the most recent statistics, its boom time in Alberta!

According to the latest figures from Canada Mortgage and Housing Corporation, builders started construction on 41,438 new homes in our province in May. That’s the highest this year and the first time since early 2008 that the figure has risen above the 40,000 mark. What’s more, the trend over the last several months clearly suggests that the housing market is heating up. Between May 2012 and May of this year, housing starts are 14.1 per cent higher than they were in the previous 12-month period.

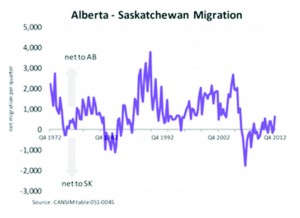

What’s causing this boom in home construction isn’t any big mystery: population growth. Even if overall economic growth has slowed somewhat, the inflow of people into our province hasn’t. The latest Labour Force Survey (released last Friday) points to a surge in the labour force, which has grown by 59,400 (+2.6 per cent) over the last 12-months. Interprovincial and international migration to Alberta is driving some of the demand for new homes. High wages, low unemployment and a younger population are also contributing factors.

The strong housing starts number this morning is supported by another figure from Friday’s employment report—the number of construction jobs is also rising. Even if jobs in the energy patch and manufacturing have eased back a bit, employment in construction continues to provide some great work opportunities.